Vea también

03.04.2025 11:00 AM

03.04.2025 11:00 AMToday, the GBP/USD pair is showing strong growth, reaching levels last seen in October 2024. This is driven by bearish momentum in the U.S. dollar, which has created favorable conditions for the British pound.

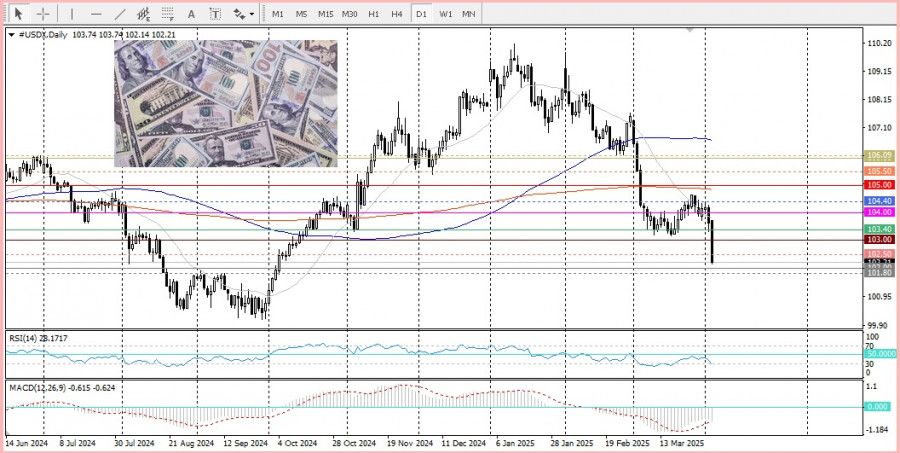

The decline in the U.S. Dollar Index to a new yearly low, in response to trade tariffs introduced by U.S. President Donald Trump, has heightened expectations for the Federal Reserve to begin a rate-cutting cycle sooner. As a result, U.S. Treasury yields have dropped sharply, undermining the dollar.

At the same time, the Bank of England is expected to cut rates more gradually than other central banks, including the Fed, which provides additional support to the pound. This further fuels demand for the British currency, helping the GBP/USD pair to rise.

From a technical perspective, the breakout above the psychological level of 1.3000 confirms the exit from a multi-week trading range, opening the way toward new targets. There is a high probability that GBP/USD could soon reach the 1.3180 area and the round level of 1.3200. However, it's important to note that oscillators on the daily chart are approaching overbought territory. Therefore, initiating new long positions at this moment may be premature—it's better to wait for consolidation or a short-term pullback.

On the other hand, the 1.3000 level now acts as a key support. A break below it would shift the bias in favor of the bears, pushing the pair back into its previous range. The nearest support is located around the 1.3100 round level, which the pair may revisit during consolidation, or to the 1.3056–1.3100 zone before potentially continuing its upward movement.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El petróleo respira cambios. La política y la economía vuelven a entrelazarse en un nudo apretado, y los activos de materias primas —especialmente el petróleo y el gas— se convierten

Los futuros del petróleo Brent subieron a aproximadamente $71,3 por barril el martes, marcando la tercera sesión consecutiva de crecimiento, ya que la tensión en Medio Oriente eclipsó otros acontecimientos

El mercado bursátil vuelve a subir, con el S&P 500 en la cúspide de la euforia. ¿Qué será lo próximo? ¿Los aranceles y la política de la Reserva Federal reforzarán

El jueves, los futuros de las acciones estadounidenses permanecen prácticamente sin cambios después de un impresionante rally en la sesión de trading anterior, cuando el S&P 500 alcanzó máximos históricos

Análisis de operaciones y consejos para operar con el yen japonés La prueba del precio 155.96 coincidió con el momento en que el indicador MACD apenas comenzaba a moverse hacia

Análisis de operaciones y consejos para operar con la libra esterlina. La primera prueba del precio 1.2184 en la segunda mitad del día coincidió con el momento

Análisis de las operaciones y consejos para operar con el euro. La prueba del precio 1.0282 en la segunda mitad del día coincidió con el momento en que el indicador

Análisis de las operaciones y consejos para operar con el yen japonés La prueba del nivel de precio 157.98 coincidió con el momento en que el indicador MACD había descendido

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.