Vea también

31.01.2025 05:44 PM

31.01.2025 05:44 PMToday, investor attention will be focused on the Personal Consumption Expenditures (PCE) Price Index, scheduled for 13:30 GMT. If the data exceeds expectations, the Federal Reserve may maintain its hawkish stance, potentially leading to a decline in both stock and crypto markets. However, if the figures remain stable or decline, the US dollar may come under pressure, increasing the likelihood of further crypto market growth.

Market outlook

In general, Bitcoin and other cryptocurrencies remain in an uptrend. If there are no negative macroeconomic surprises, the crypto market may continue to strengthen.

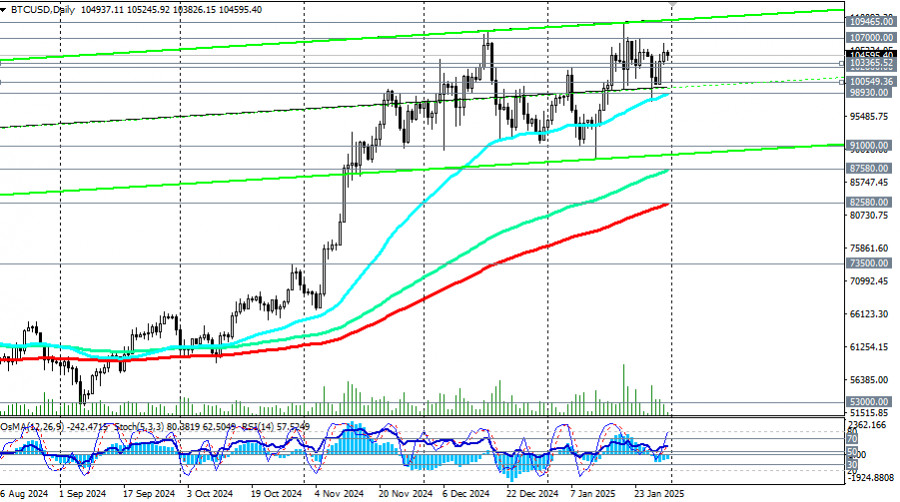

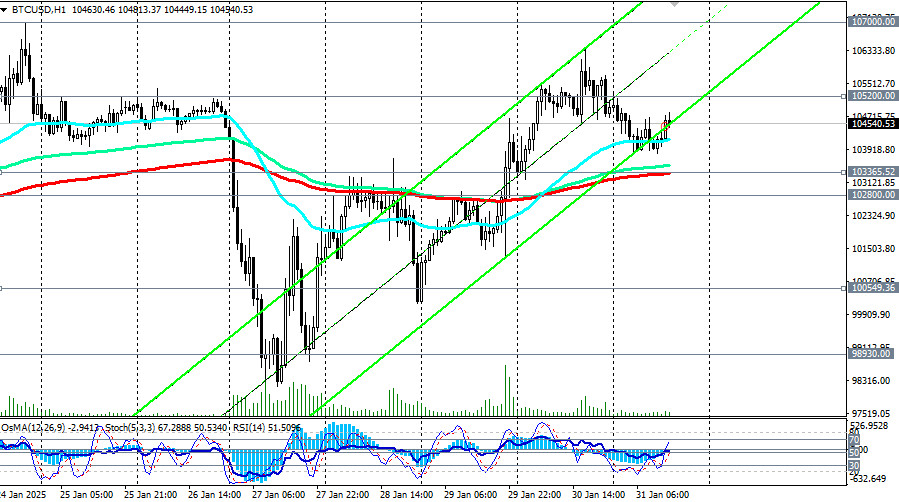

Long positions are preferred for BTC/USD. A break above the local resistance of 107,000.00 could serve as a signal for new buying opportunities, with an earlier signal triggered by a breakout above 105,200.00.

The alternative bearish scenario would be confirmed by a break below today's low of 103,826.00, leading to further declines toward key support levels at 103,365.00 (200 EMA on the 1-hour chart), 102,800.00, 100,550.00 (200 EMA on the 4-hour chart), and 98,930.00 (50 EMA on the daily chart).

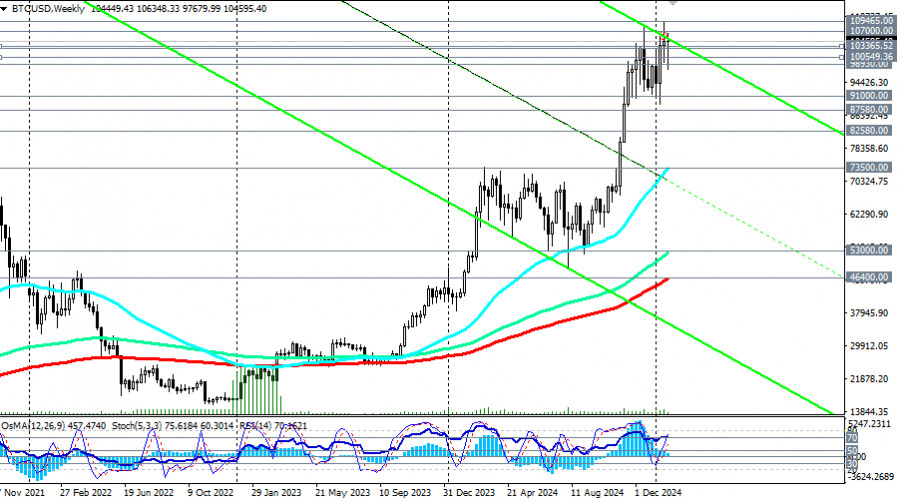

A deeper correction could bring BTC down to the local support level of 91,000.00. A break below this level might trigger a larger sell-off toward 75,000.00, as suggested by some economists.

From both a technical and fundamental perspective, considering Trump's statements about making the US a "crypto haven," the outlook for digital assets—especially Bitcoin—remains positive. As a result, long positions remain preferable for BTC/USD.

Key support and resistance levels

Support levels: 103,820.00, 103,365.00, 103,000.00, 102,800.00, 102,000.00, 100,500.00, 100,000.00, 99,000.00, 98,930.00, 91,000.00, 87,500.00, 82,580.00, 81,100.00, 80,000.00

Resistance levels: 105,000.00, 105,200.00, 106,000.00, 107,000.00, 108,000.00, 109,000.00, 109,500.00, 110,000.00

Trading scenarios

Main scenario (bullish):

Buy stop at 105,210.00, 106,000.00, 107,100.00

Stop-loss: 103,300.00

Targets: 108,000.00, 109,000.00, 109,500.00, 110,000.00

Alternative scenario (bearish):

Sell stop at 103,300.00

Stop-loss: 104,700.00

Targets: 103,000.00, 102,800.00, 102,000.00, 100,500.00, 100,000.00, 99,000.00, 98,930.00, 91,000.00, 87,500.00, 82,580.00, 81,100.00, 80,000.00

Note: The target levels correspond to support and resistance levels. This does not guarantee that they will be reached, but they serve as reference points for trade planning and position placement.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El Bitcoin se está recuperando, pero su potencial de crecimiento es limitado. Últimamente ha habido pocas noticias del mundo de las criptomonedas, y Donald Trump continúa imponiendo sanciones, aranceles

El Bitcoin y el Ether mostraron una estabilidad bastante buena durante el fin de semana, preservando las posibilidades de una mayor recuperación. Y aunque desde un punto de vista técnico

El Bitcoin y el Ether han estado en demanda durante los últimos días de negociación, manteniendo sus posibilidades de recuperarse de la venta masiva vista la semana pasada debido

El Bitcoin vuelve a recuperarse rápidamente y Donald Trump sigue agitando los mercados. Solo en el día de ayer se recibió tal cantidad de noticias sobre la Guerra Comercial Mundial

El Bitcoin y el Ethereum se están recuperando gradualmente después de la fuerte venta masiva que ocurrió a principios de esta semana. La situación en el mercado bursátil estadounidense

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.