Triple Bottom

was formed on 03.04 at 23:00:23 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of GBPJPY M5. Features of the pattern: The lower line of the pattern has coordinates 191.85 with the upper limit 191.85/191.40, the projection of the width is 73 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 191.12, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

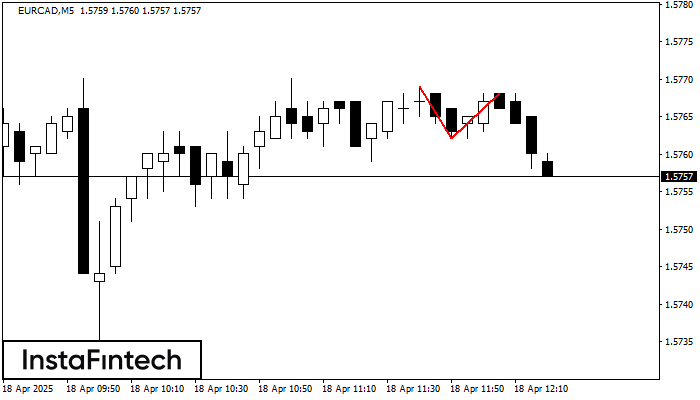

Double Top

was formed on 18.04 at 11:20:17 (UTC+0)

signal strength 1 of 5

The Double Top reversal pattern has been formed on EURCAD M5. Characteristics: the upper boundary 1.5769; the lower boundary 1.5762; the width of the pattern is 6 points. Sell trades

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

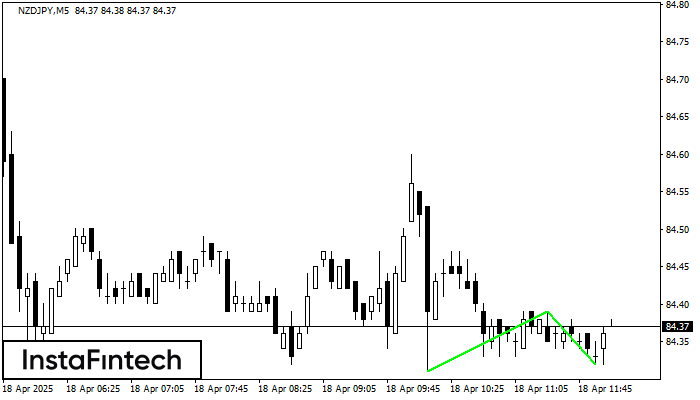

Double Bottom

was formed on 18.04 at 11:05:30 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on NZDJPY M5; the upper boundary is 84.39; the lower boundary is 84.32. The width of the pattern is 8 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Double Bottom

was formed on 18.04 at 11:00:39 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on NZDCHF M15. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should

The M5 and M15 time frames may have more false entry points.

Open chart in a new window