Veja também

03.04.2025 09:02 AM

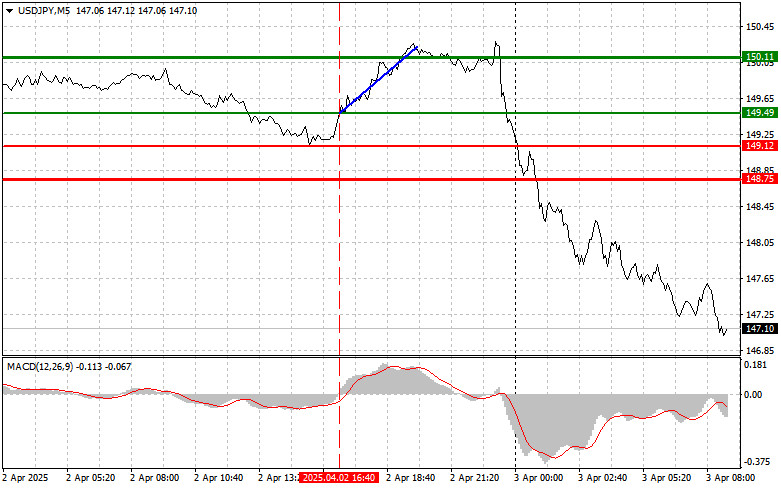

03.04.2025 09:02 AMThe price test at 149.49 occurred when the MACD indicator had just started moving up from the zero line, confirming the validity of the entry point for buying the dollar. As a result, the pair rose by more than 60 pips, breaking through the target level of 150.11.

However, today, pressure on the dollar has returned, and the yen has significantly strengthened. Yesterday, it was announced that the US would impose a 24% tariff on all imports from Japan. However, as the chart shows, the yen appeared to be prepared for this — there was virtually no reaction to the new tariffs.

Given the ongoing tension in US-Japan relations and the American president's campaign statements, the markets may have priced in such a scenario in advance. Another possibility is that Japanese exporters had already adapted to potential restrictions by adjusting supply chains or signing advance contracts. The long-term impact of these tariffs on the Japanese economy will undoubtedly be significant. Retaliatory tariffs and reduced export volumes to the US may lead to a decline in industrial output and, as a result, a slowdown in economic growth.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

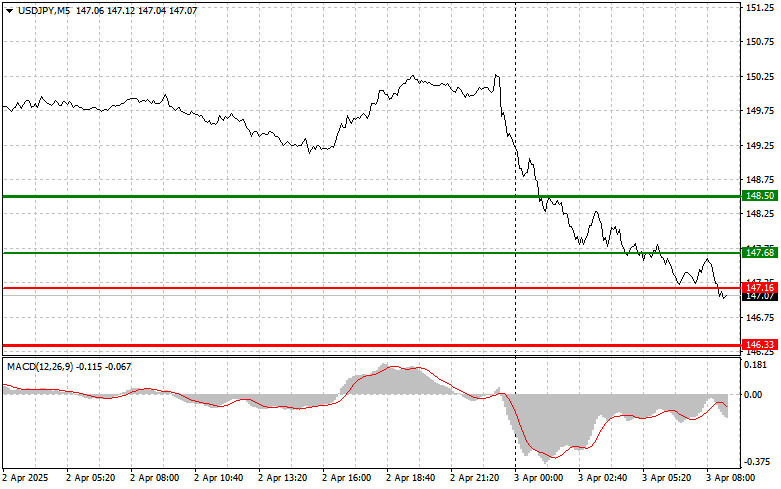

Scenario #1: Today, I plan to buy USD/JPY at the entry point around 147.68 (green line on the chart), with a target at 148.50 (thicker green line). Around 148.50, I plan to exit long positions and open short positions in the opposite direction (expecting a pullback of 30–35 pips). It's best to re-enter long positions during corrections or significant dips in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy USD/JPY today if the pair tests the 147.16 level twice consecutively while the MACD indicator is in the oversold zone. This would limit the pair's downside potential and result in an upward market reversal. A move toward 147.68 and 148.50 can be expected.

Scenario #1: I plan to sell USD/JPY today only after a confirmed break below 147.16 (red line on the chart), which would likely result in a sharp decline. The main target for sellers will be 146.33, where I intend to exit shorts and immediately open long positions (expecting a 20–25 pip retracement). Bearish pressure on the pair could return at any moment. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to move down from it.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 147.68 level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a market reversal downward. A decline toward 147.16 and 146.33 can be expected.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

O euro e a libra esterlina conseguiram resistir à renovada pressão vendedora, chegando até a recuperar parte de suas posições durante a sessão asiática desta quinta-feira. Na véspera, Donald Trump

O teste do nível de 147,13 ocorreu exatamente quando o indicador MACD começou a subir a partir da linha zero, confirmando um ponto de entrada válido para a compra

Análise das operações e dicas para a libra esterlina O teste de preço em 1,2882 ocorreu no momento em que o indicador MACD havia acabado de iniciar um movimento descendente

Análise e recomendações de negociação para o euro O teste de preço de 1,0975 ocorreu quando o indicador MACD tinha acabado de começar a se mover para baixo a partir

Contas PAMM

da InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.