یہ بھی دیکھیں

29.01.2024 03:35 PM

29.01.2024 03:35 PMThe past week marked a new phase of corrective movement for the main cryptocurrency and the entire market. Bitcoin, after plummeting to $42k, consolidated and resisted dropping below $40.5k, rarely testing this support zone. However, last week, the $42k level was breached, and subsequently, due to high selling volumes, the $40.5k level was also breached.

The cryptocurrency continued to fluctuate near $40.5k, but eventually, the key support level of $40.5k was also breached. Selling pressure increased, leading Bitcoin to retest the $39k level and briefly reaching $38.5k, where a local high was established. A subsequent local upward correction followed, which, by all metrics, appeared anomalous. However, the unlikely bullish BTC forecast was fulfilled, and the cryptocurrency confidently settled above $40k and later to $41k.

Recovery above $40k and the subsequent price increase to $42k marked the triumphant return of buyers to the market. This process coincided with the final exhaustion of sales volumes from the Grayscale fund, according to JPMorgan's data. If we follow the scenario that the decline in BTC/USD is solely due to Grayscale's massive sell-off, we should expect the value of BTC to recover to $45k and beyond in the new trading week.

However, from a technical standpoint, the situation looks more complex. If we conduct a Fibonacci retracement from the local peak at $48.9k to the current low at $38.5k, it turns out that the upward correction of BTC/USD at this stage has only reached the 0.382 Fibonacci level, which, in most cases, is not the final point. Typically, an asset's correction within an impulse wave concludes between the 0.500 and 0.618 levels. This suggests that Bitcoin has the potential to rise to $45k, and this price movement will be within the framework of a significant downward trend.

Considering this, purely from an analytical perspective, the correction of BTC/USD has likely ended since the structure of the local downward trend has been violated. However, from a broader perspective and in terms of technical analysis, Bitcoin needs to consolidate above $45k for a definitive break in bearish sentiment and a resumption of movement towards new highs.

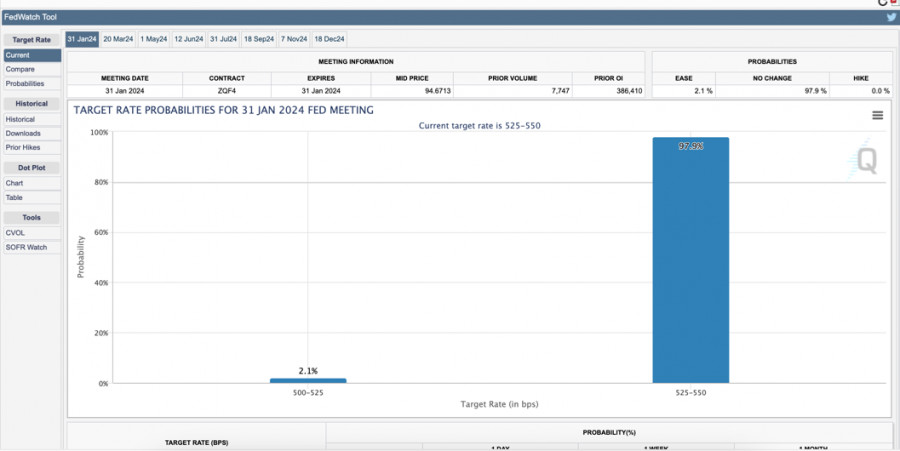

On January 31, the long-awaited Federal Reserve meeting will take place, which will determine the future of financial markets in the coming weeks. This decision will be crucial for the crypto market, as it will finally clarify when the authority plans to initiate an interest rate easing policy. The latest inflation data, the stability of the U.S. economy, and a robust labor market add doubts to investors about whether the Federal Reserve will start lowering interest rates in the first half of 2024.

Analysts at Nomura believe that over the next 12 months of this year, the interest rate will be lowered by 1%, but when the process will begin is still unknown. Investors are eager to hear this information at the upcoming press conference of Jerome Powell, as the markets have no doubts that the interest rate will remain at current levels. The concern lies in the possibility of another rate hike to 5.75%, and it is this possibility that raises doubts among investors.

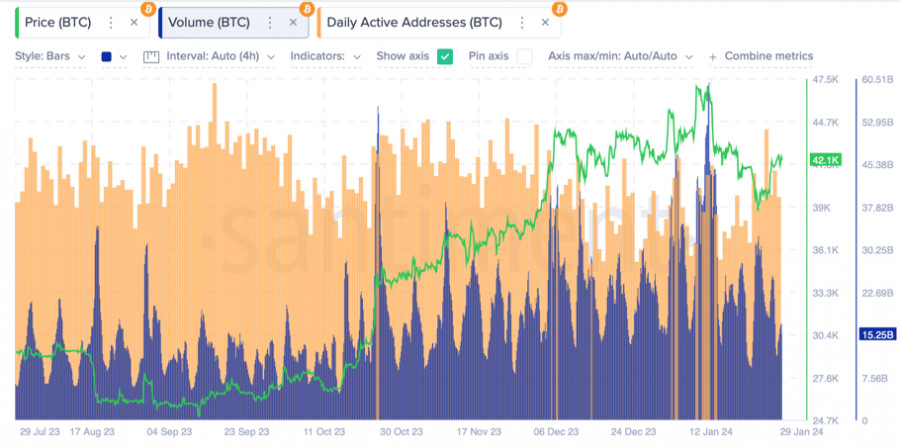

Meanwhile, the Bitcoin market is experiencing a local calm after active weekends, and there are all reasons to believe that the current level of trading activity will continue until Wednesday. It is also quite likely that the asset will make a preemptive price move, trying to anticipate the actions of the Federal Reserve. As of January 29th, BTC/USD is trading at $42.1k, with daily trading volumes around $15 billion. Significant growth in the activity of unique addresses in the BTC network is also noted, which is a bullish signal.

However, as we have already noted, Bitcoin may continue to rise to $45k within the framework of the global downward trend. Considering this, it is worth highlighting a key level, in addition to $45k, which will serve as a magnet for the price in case of further price rallies. The nearest resistance level is located at $43.8k, at the 0.5 Fibonacci level. There is a possibility that the upward correction of the asset may end here, after which the next impulse to $37k will follow.

Bitcoin is at a crossroads, and the Federal Reserve meeting may provide answers to all the questions of interest to us. With a high probability, Jerome Powell's rhetoric will not be optimistic, and therefore, Bitcoin will likely continue to rise and reach the $43.8–$45k range, after which a new downward impulse will begin. However, one cannot exclude the activation of buyers and successful consolidation above this area, which will mark the beginning of an upward movement towards a new local high, possibly the last one before the halving.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

تربیتی ویڈیو

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.