CHFHKD (Swiss Franc vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

17 Mar 2025 07:04

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CHF/HKD currency pair is the cross rate against the U.S. dollar, which is not very popular on Forex market. As you can see, the U.S. dollar is not present in this currency pair, but it still greatly affects CHF/HKD. Just combine the USD/CHF and USD/HKD charts in the same price chart and you will get the approximate CHF/HKD chart, which proves graphically their interdependence.

Both currencies are under the strong influence from the U.S. dollar. Therefore, for a better forecasting of the future movement of this currency pair, you need to keep in mind the major indicators of the U.S. economy. These indicators include the interest rate, GDP, unemployment, new workplaces indicator and others. Please note that the Swiss franc and the Hong Kong dollar can react in a different way on changes in the economic situation of the United States.

The Swiss economy has been highly developed for several centuries. Thus, the Swiss franc is known as one the most reliable and stable of the world currencies. Because of the reason that this currency is the safest for the capital investment, that is the reason for the capital inflows to this country during the time of the economic crisis, which provokes the sharp increase of the Swiss franc value against other currencies. Don’t forget this peculiarity of the Swiss economy while trading this financial instrument.

To date, the Hong Kong dollar value is attached to the U.S. dollar. The rate of the U.S. dollar against the Hong Kong dollar is from 7.75 to 7.85.

Hong Kong has one of the largest stock exchanges in the world. Thanks to some factors, Hong Kong leaves behind the number of the major European and American stock exchanges. Today the Hong Kong Stock Exchange is regarded as a leader among the financial centers all over the world.

The economy of Hong Kong is characterized by the free trade, low tax rates and the government policy of the non-interference in the state economy. Because of its shortage in mineral and food resources, the economy of this country is highly dependent from these factors. The state revenue is provided by the service sector, the reexport from China and the well developed tourism sector.

In comparison with the major currency pairs such as EUR/USD, USD/CHF, GBP/USD and USD/JPY, this one is relatively illiquid. So when you predict the future movement of this currency pair, you should pay special attention to the currency pairs that consist of the Swiss franc and the Hong Kong dollar in tandem with the U.S. dollar.

Please remember that the spread for cross currency pairs is usually higher than for the more popular ones. Therefore, before dealing with the cross rates read and understand the broker’s conditions for this specified trade instrument.

See Also

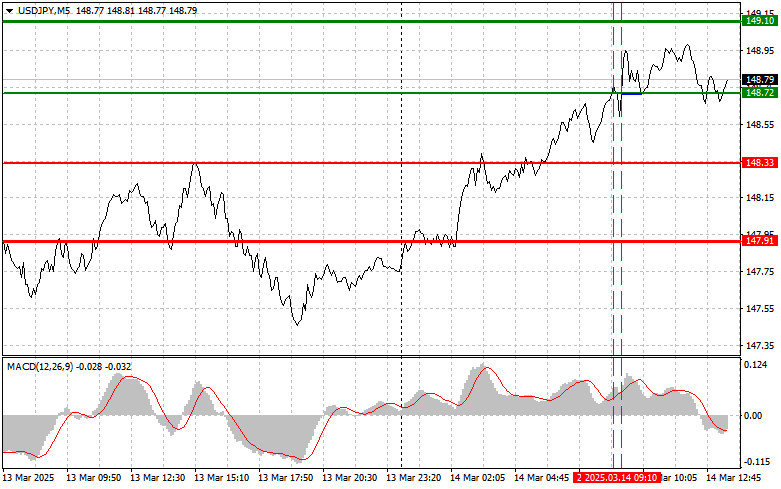

- USD/JPY: Simple Trading Tips for Beginner Traders on March 14th (U.S. Session)

Author: Jakub Novak

17:50 2025-03-14 UTC+2

2173

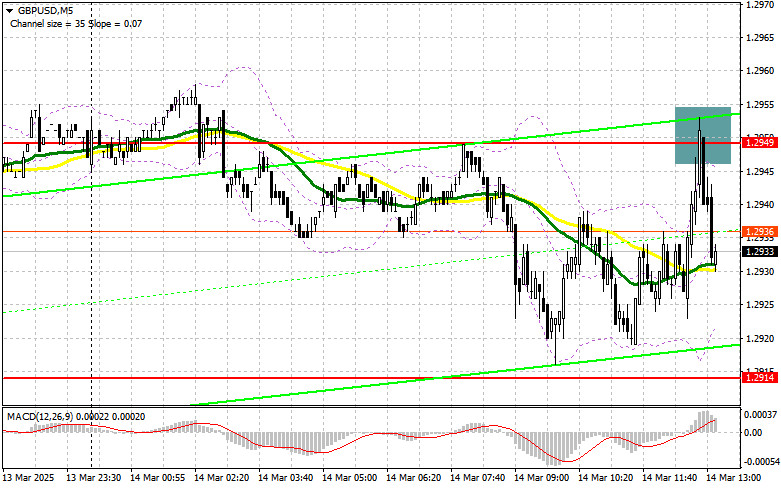

GBP/USD: Simple Trading Tips for Beginner Traders on March 14th (U.S. Session)Author: Jakub Novak

17:02 2025-03-14 UTC+2

1963

In my morning forecast, I focused on the 1.2949 level and planned to base my trading decisions on itAuthor: Miroslaw Bawulski

16:25 2025-03-14 UTC+2

1948

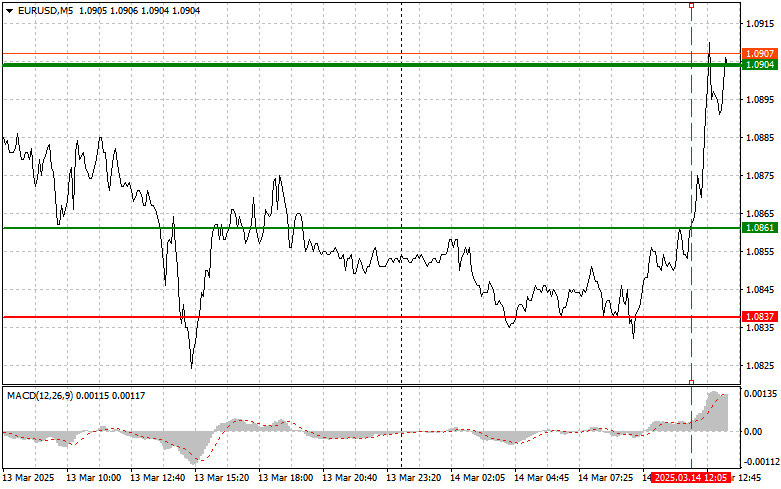

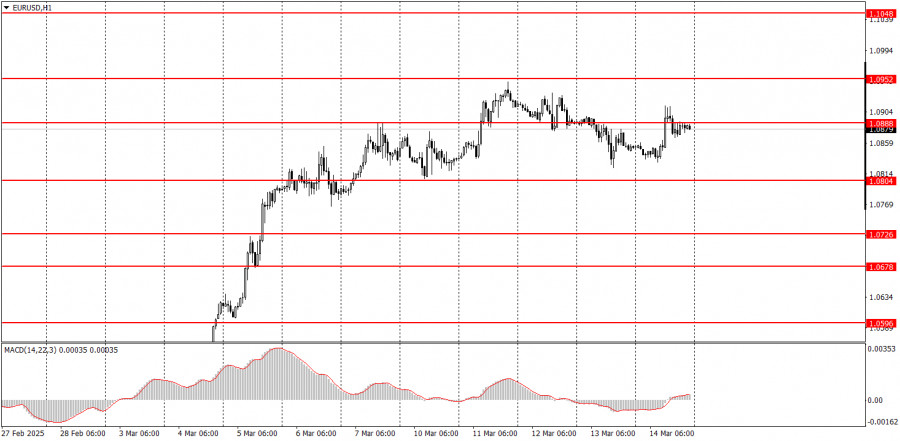

- The 1.0861 price test occurred when the MACD indicator had already risen significantly above the zero level

Author: Jakub Novak

16:40 2025-03-14 UTC+2

1858

The 1.0861 price test occurred when the MACD indicator had already risen significantly above the zero levelAuthor: Jakub Novak

16:41 2025-03-14 UTC+2

1858

America will once again be a major focus in the newsAuthor: Chin Zhao

00:05 2025-03-17 UTC+2

733

- After experiencing a significant surge of 500 pips, the EUR/USD pair has settled into a period of stagnation, awaiting further news. The Federal Reserve may either alleviate or heighten concerns about a potential recession in the U.S.

Author: Irina Manzenko

00:05 2025-03-17 UTC+2

703

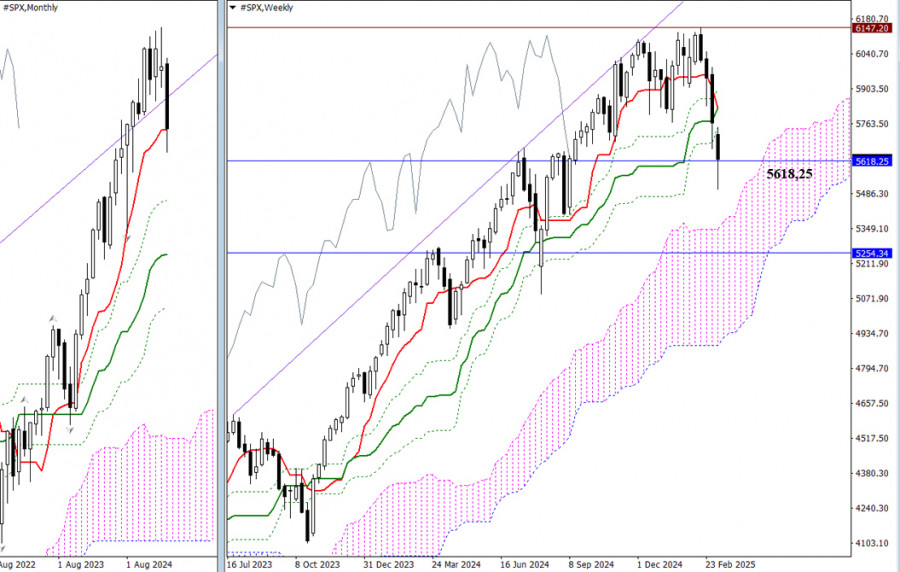

Last week, the bears continued to decline but failed to close below the tested support level of the monthly short-term trend at 5618.25, only leaving a long lower shadow beyond it. A break below this level would lead to a retest of the weekly Ichimoku crossAuthor: Evangelos Poulakis

23:25 2025-03-16 UTC+2

673

Fundamental analysisWhat to Pay Attention to on March 17? A Breakdown of Fundamental Events for Beginners

There are very few macroeconomic events scheduled for MondayAuthor: Paolo Greco

23:27 2025-03-16 UTC+2

658

- USD/JPY: Simple Trading Tips for Beginner Traders on March 14th (U.S. Session)

Author: Jakub Novak

17:50 2025-03-14 UTC+2

2173

- GBP/USD: Simple Trading Tips for Beginner Traders on March 14th (U.S. Session)

Author: Jakub Novak

17:02 2025-03-14 UTC+2

1963

- In my morning forecast, I focused on the 1.2949 level and planned to base my trading decisions on it

Author: Miroslaw Bawulski

16:25 2025-03-14 UTC+2

1948

- The 1.0861 price test occurred when the MACD indicator had already risen significantly above the zero level

Author: Jakub Novak

16:40 2025-03-14 UTC+2

1858

- The 1.0861 price test occurred when the MACD indicator had already risen significantly above the zero level

Author: Jakub Novak

16:41 2025-03-14 UTC+2

1858

- America will once again be a major focus in the news

Author: Chin Zhao

00:05 2025-03-17 UTC+2

733

- After experiencing a significant surge of 500 pips, the EUR/USD pair has settled into a period of stagnation, awaiting further news. The Federal Reserve may either alleviate or heighten concerns about a potential recession in the U.S.

Author: Irina Manzenko

00:05 2025-03-17 UTC+2

703

- Last week, the bears continued to decline but failed to close below the tested support level of the monthly short-term trend at 5618.25, only leaving a long lower shadow beyond it. A break below this level would lead to a retest of the weekly Ichimoku cross

Author: Evangelos Poulakis

23:25 2025-03-16 UTC+2

673

- Fundamental analysis

What to Pay Attention to on March 17? A Breakdown of Fundamental Events for Beginners

There are very few macroeconomic events scheduled for MondayAuthor: Paolo Greco

23:27 2025-03-16 UTC+2

658