Triple Bottom

was formed on 03.04 at 23:00:23 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of GBPJPY M5. Features of the pattern: The lower line of the pattern has coordinates 191.85 with the upper limit 191.85/191.40, the projection of the width is 73 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 191.12, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

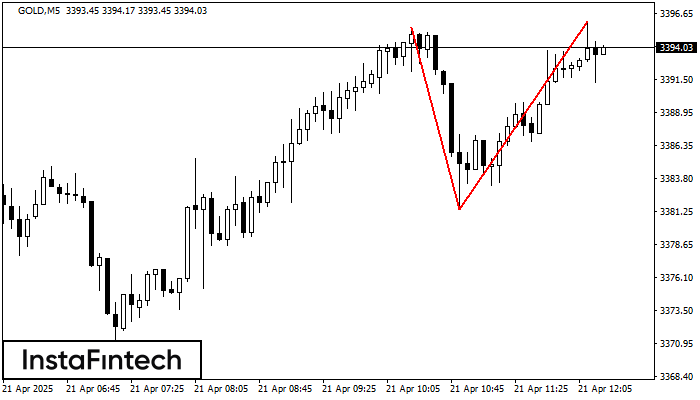

Double Top

сформирован 21.04 в 11:20:02 (UTC+0)

сила сигнала 1 из 5

The Double Top reversal pattern has been formed on GOLD M5. Characteristics: the upper boundary 3395.58; the lower boundary 3381.38; the width of the pattern is 1463 points. Sell trades

The M5 and M15 time frames may have more false entry points.

Открыть график инструмента в новом окне

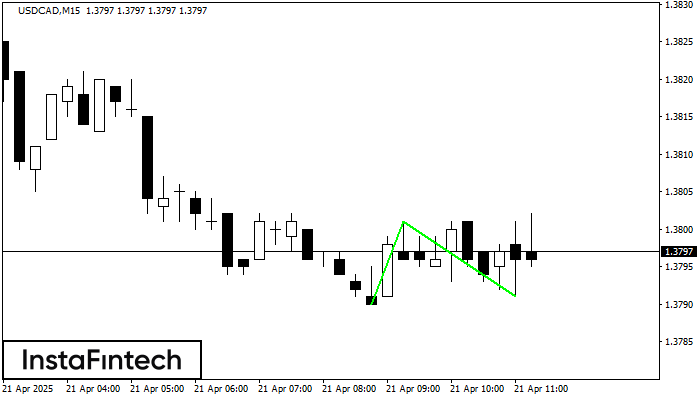

Double Bottom

сформирован 21.04 в 10:30:12 (UTC+0)

сила сигнала 2 из 5

The Double Bottom pattern has been formed on USDCAD M15; the upper boundary is 1.3801; the lower boundary is 1.3791. The width of the pattern is 11 points. In case

The M5 and M15 time frames may have more false entry points.

Открыть график инструмента в новом окне

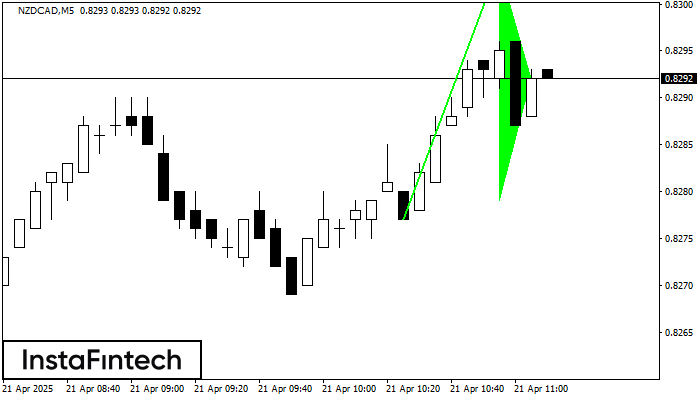

Bullish pennant

сформирован 21.04 в 10:10:25 (UTC+0)

сила сигнала 1 из 5

The Bullish pennant signal – Trading instrument NZDCAD M5, continuation pattern. Forecast: it is possible to set up a buy position above the pattern’s high of 0.8304, with the prospect

The M5 and M15 time frames may have more false entry points.

Открыть график инструмента в новом окне