Lihat juga

08.04.2024 02:27 PM

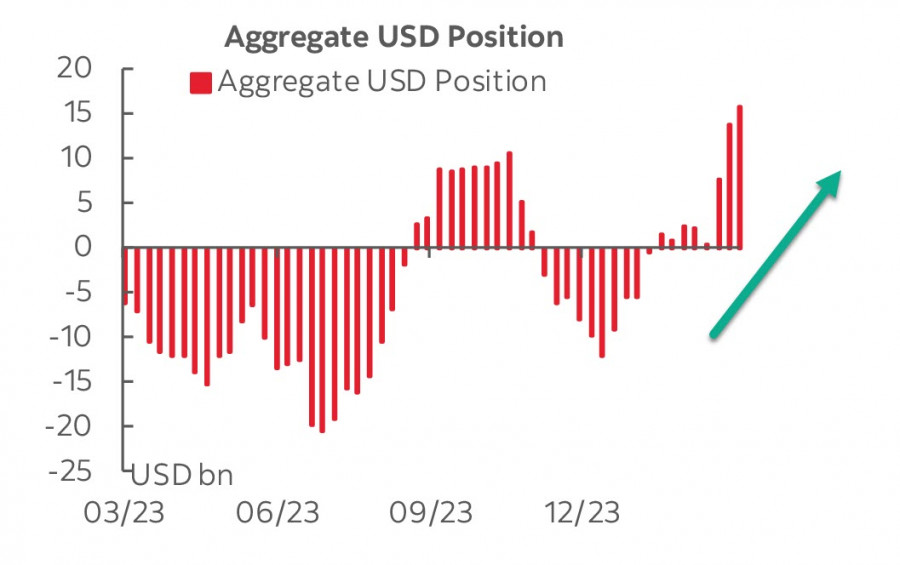

08.04.2024 02:27 PMThe net long dollar position increased by another $2.4 billion over the reporting week, totaling $16.1 billion, showing confidently bullish positioning. The dollar gained mainly against the euro and the yen, with minor repositioning against other currencies.

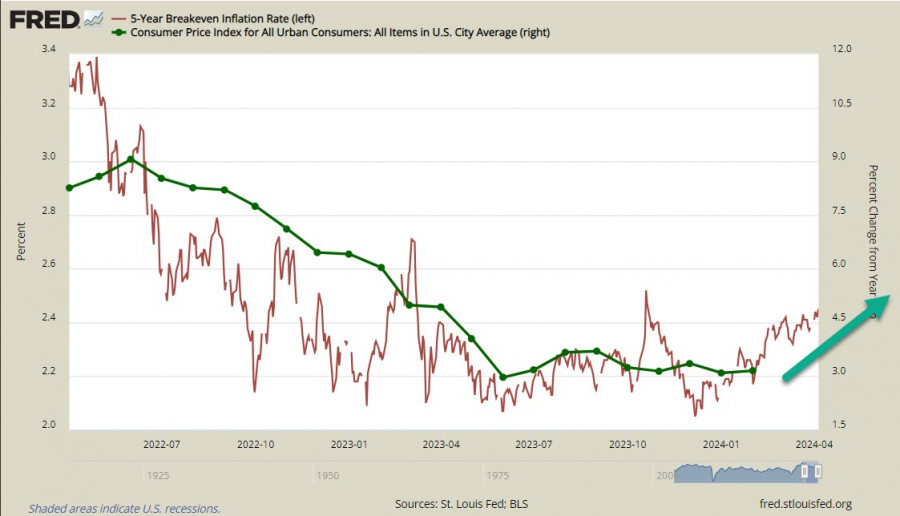

The increase in the long dollar position is logical and easily explained: the more the market doubts that the Fed will begin to cut rates, the longer the dollar will remain in a high-rate environment, the higher its yield relative to other currencies, and therefore, the higher the demand for the dollar.

The US labor market report also came with surprises. Data showed that the market added 303,000 nonfarm payroll jobs in March, significantly more than both the 200,000 expected by economists and the historical average of 190,000. The report also showed that the average hourly earnings increased by 0.3% month-on-month, indicating accelerated wage growth, which causes inflation-related concern among Fed policymakers. Fed representatives Logan and Bowman described the current situation almost identically, saying that inflation progress has stalled. Yes, the inflation situation is rather complicated, but such reports favorably affect the dollar, enhancing its bullish prospects.

During Easter celebrations, Fed Chair Jerome Powell signaled that strong data make it possible to postpone the rate cut cycle to gain more confidence in inflation cooling. The yield on TIPS bonds, an excellent indicator of inflation expectations, is rising. In December, it dropped to 2.06%, while on Friday, the indicator rose to a more than five-month high of 2.45%.

In addition to jobs data, other reports were quite optimistic. The US Manufacturing ISM was significantly above expectations in March, indicating the start of production expansion for the first time since 2022. US consumption expanded by 0.4% in February, and the Services ISM in March slightly decreased from February but remained in growth territory.

Positive data acts as a driving force behind the US dollar's rally amidst changing forecasts for the Fed's rate. If at the beginning of last week, investors leaned towards the first rate cut occurring in June with a total of 3 cuts in 2024, by the end of the week, expectations for the first cut were evenly split between June and July.

This indicates that the dollar looks more than confident compared to its competitors. There is virtually no reason for selling it, except for one factor - a rise in gold prices, which may indicate an overall increase in demand for safe-haven assets in anticipation of a global slowdown.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Minggu ini, Kesatuan Eropah dan Amerika Syarikat tidak mencapai kemajuan yang signifikan dalam menyelesaikan pertikaian perdagangan, kerana pegawai dari pentadbiran Presiden Donald Trump menunjukkan bahawa kebanyakan tarif yang dikenakan oleh

Emas terus menarik perhatian pelabur, terutamanya dalam tempoh ketidaktentuan yang tinggi di pasaran kewangan. Ketidaktentuan Perdagangan: Ketidaktentuan yang berterusan dalam hubungan perdagangan antara AS dan China menjadikan emas sebagai aset

Optimisme pasaran, yang didorong oleh manipulasi naratif tarif secara aktif oleh Donald Trump, tidak bertahan lama. Pedagang tetap memberi tumpuan kepada ketegangan yang semakin meningkat antara A.S. dan China selepas

Analisis Laporan Makroekonomi: Beberapa acara makroekonomi dijadualkan pada hari Rabu, dan terdapat juga laporan penting yang akan diterbitkan. Namun begitu, isu utama ketika ini bukanlah sejauh mana signifikan laporan-laporan tersebut

Pada hari Selasa, pasangan mata wang GBP/USD terus menunjukkan pergerakan menaik. Walaupun kenaikan kali ini tidak sekuat lonjakan minggu lalu, pound British terus meningkat dengan stabil, hampir tanpa sebarang pembetulan

Pasangan mata wang EUR/USD kekal hampir mendatar sepanjang hari Selasa. Walaupun kedua-dua pasangan sedang berada dalam aliran menaik, euro dan pound British sejak kebelakangan ini tidak lagi bergerak seiring. Kedua-duanya

Euro menunjukkan reaksi negatif terhadap indeks ZEW yang dikeluarkan pada hari Selasa, yang mencerminkan peningkatan pesimisme dalam persekitaran perniagaan Eropah. Petunjuk utama jatuh ke kawasan negatif buat pertama kali dalam

Kenaikan euro ke kawasan tertinggi dalam tiga tahun menjadi berpotensi ekoran rangsangan fiskal Jerman, dasar perdagangan Donald Trump, dan aliran keluar modal dari Amerika Utara ke Eropah. Apabila pelabur berhenti

Video latihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.