यह भी देखें

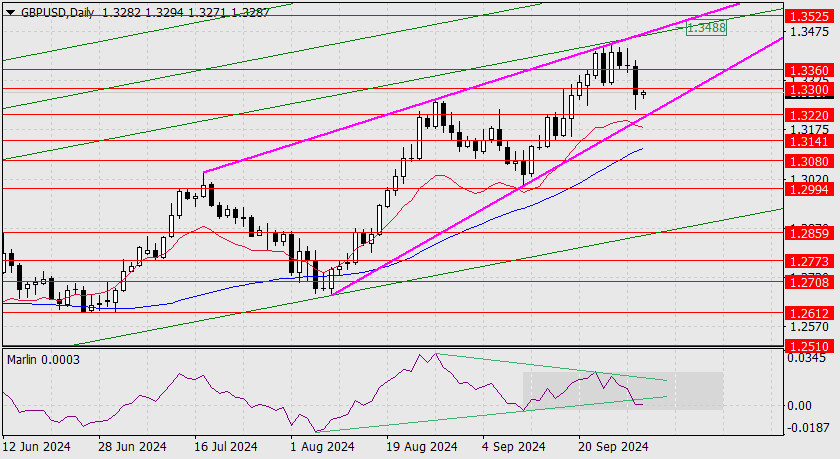

Under the influence of external factors, the British pound fell by 89 pips yesterday. The lower shadow narrowly missed reaching the target level of 1.3220. The Marlin oscillator exited the wedge downward and could potentially continue the sideways trend within the boundaries of the gray rectangle range.

Overall, the British pound continues to develop within an ascending wedge, delaying the test of the target level at 1.3525, from which we expect a major reversal in the medium- and long-term downward trend. This decline will be more connected to the outcome of the U.S. presidential election than the conflict in the Middle East. However, of course, all political events are interrelated and should be considered in balance.

On the four-hour chart, the price is attempting to return above the 1.3300 level. The pound will likely try to break through 1.3360 if it consolidates above this level.

The MACD line supports this level, so additional conditions will be required for a breakthrough. Tomorrow, the PMI indices for the U.S. will be published, which might help the pound.

If the pound breaks support at 1.3220, it will exit the wedge on the daily chart, with Marlin settling into bearish territory. It will then proceed to attack the support of the MACD line (1.3141) on a daily scale. A move below this level will confirm the path of further medium-term depreciation of the British currency.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |