Lihat juga

07.04.2025 07:16 PM

07.04.2025 07:16 PMTrade Analysis and Advice for the Euro

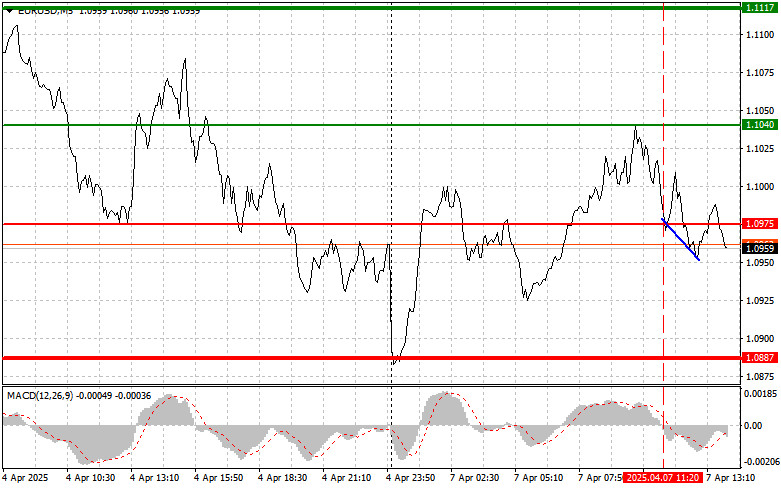

The price test of 1.0975 occurred when the MACD indicator had just started moving down from the zero mark, which confirmed a valid entry point for selling the euro and resulted in a 15-point drop in the pair.

Now, as uncertainty in the global economy intensifies, investors are increasingly turning to safe-haven assets such as the U.S. dollar. The euro, on the other hand, is perceived as a riskier instrument, especially amid unclear prospects for further monetary policy decisions from the ECB. Technical analysis also confirms euro weakness. In such a situation, traders dealing with the euro should exercise particular caution. Opening long positions is justifiable only if there are clear signs of a reversal in the bearish trend — which is currently absent.

In the second half of the day, market attention will focus on U.S. consumer credit data and a speech by FOMC member Adriana D. Kugler. These events could potentially adjust market expectations, as they provide traders with fresh insights into the state of the economy and possible changes in monetary policy. Consumer credit is a significant indicator reflecting household spending activity. An increase in lending volumes may indicate consumer optimism about their financial situation. At the same time, excessively rapid growth in consumer credit could signal risks of economic overheating and excessive household debt. The dollar is largely indifferent to these factors, so I don't expect a strong reaction.

Adriana D. Kugler's speech may provide more clarity on the FOMC's current outlook regarding inflation, employment, and the overall economic forecast. Any signals suggesting potential policy adjustments could trigger fluctuations in financial markets. However, considering the Fed officials' current hawkish stance, her remarks are likely to favor the dollar.

As for the intraday strategy, I will rely primarily on the implementation of Scenarios #1 and #2.

Buy Signal

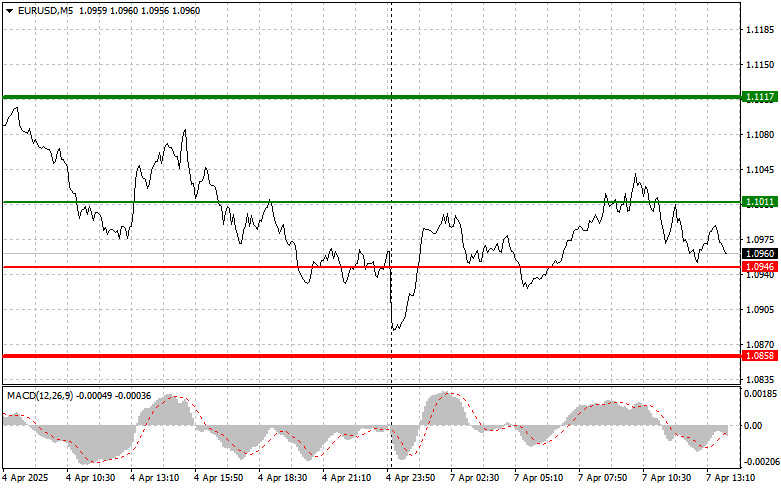

Scenario #1: I plan to buy the euro today if the price reaches the area around 1.1011 (green line on the chart), with a target of growth to the level of 1.1117. At 1.1117, I plan to exit long positions and open shorts in the opposite direction, expecting a 30–35 point pullback. Counting on euro growth today will be difficult. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.0946 level, when the MACD indicator is in the oversold area. This would limit the downward potential and lead to a market reversal to the upside. One can expect growth to the opposite levels of 1.1011 and 1.1117.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the level of 1.0946 (red line on the chart). The target will be the 1.0858 level, where I plan to exit short positions and open long ones in the opposite direction (expecting a 20–25 point move in the opposite direction). Pressure on the pair is likely to return today if strong data comes out. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to move down from it.

Scenario #2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1011 level, when the MACD indicator is in the overbought area. This would limit the upward potential and lead to a market reversal downward. One can expect a decline to the opposite levels of 1.0946 and 1.0858.

Chart Explanation:

Important: Beginner Forex traders must be extremely cautious when deciding to enter the market. It's best to stay out before major fundamental reports are released to avoid being caught in sharp price swings. If you decide to trade during news events, always place stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you trade large volumes and don't use proper money management. And remember, successful trading requires a clear trading plan like the one I've outlined above. Making spontaneous decisions based on current market conditions is a losing strategy for intraday trading.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian harga pada 142,20 terjadi ketika indikator MACD sudah bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual dolar. Saya juga

Uji harga di 1,3268 terjadi ketika indikator MACD bergerak jauh di atas garis nol, membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli pound. Hari ini, dolar

Level yang saya tandai tidak diuji pada paruh kedua hari. Hal ini disebabkan oleh libur pasar dan penutupan beberapa bursa utama. Selama sesi Asia hari ini, dolar AS mengalami penurunan

Analisis trading dan kiat-kiat trading untuk yen Jepang Pengujian level harga 142,51 terjadi ketika indikator MACD sudah bergerak jauh di bawah angka nol, yang membatasi potensi penurunan pasangan ini. Oleh

Analisis trading dan tips trading untuk pound Inggris Uji level harga 1.3257 terjadi ketika indikator MACD sudah bergerak jauh di bawah tanda nol, yang membatasi potensi penurunan pasangan ini. Oleh

Analisis dan Kiat-kiat Trading Euro Uji level harga 1,1344 terjadi ketika indikator MACD sudah bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Oleh karena itu, saya

Uji harga pada 142,69 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang tepat untuk membeli dolar. Akibatnya, pasangan ini hanya naik 15 poin

Tidak ada pengujian terhadap level yang saya sebutkan pada paruh pertama hari ini. Bahkan dengan rilis data inflasi penting dari Inggris, berkurangnya volatilitas pasar mencegah pasangan ini mencapai level-level kunci

Ulasan Trading dan Panduan untuk Trading Euro Tidak ada pengujian terhadap level yang saya sebutkan di paruh pertama hari ini. Bahkan dengan rilis data inflasi penting, volatilitas pasar yang berkurang

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.