Lihat juga

04.04.2025 09:09 AM

04.04.2025 09:09 AMBitcoin and Ethereum were able to withstand significant pressure again, which was exerted on them yesterday in the latter part of the day following a substantial sell-off in the U.S. stock market—an increasingly correlated counterpart to the cryptocurrency market.

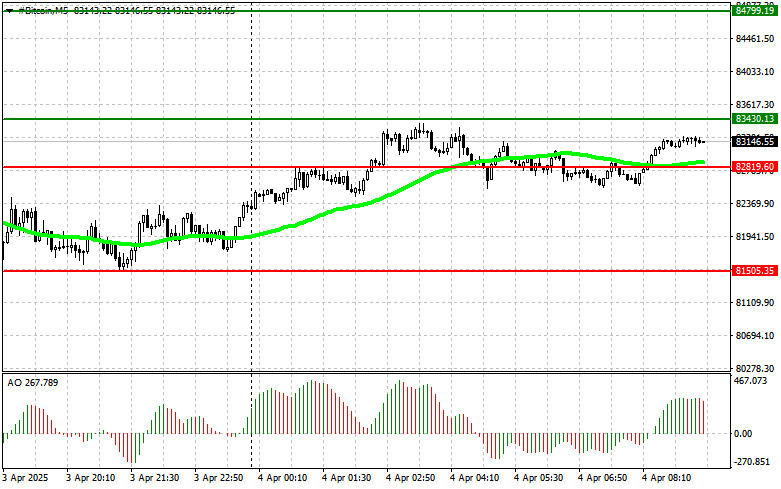

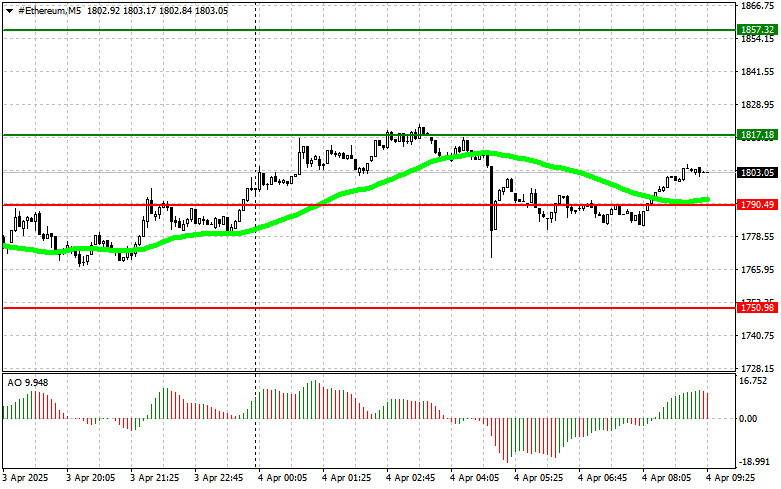

Another unsuccessful attempt by Bitcoin to drop below $81,000 sparked buying interest from large investors. The asset is currently trading at around $83,200. Ethereum was also fortunate: after hitting a low of $1,750 during yesterday's U.S. session, it is now trading around $1,804.

Ethereum may receive support soon, as developers have officially scheduled the Pectra upgrade for launch on the Ethereum mainnet on May 7. Pectra is expected to bring several key improvements aimed at enhancing the efficiency and functionality of the Ethereum network. These include optimization of the Ethereum Virtual Machine (EVM), lower gas fees (transaction costs), and enhanced staking capabilities. Additionally, the update will address network security and privacy. The Pectra launch marks an important milestone in Ethereum's development, showcasing the developers' commitment to continuous improvement and adaptation to changing market demands. Successful deployment could positively influence ETH's price and attract new users and developers to the Ethereum ecosystem.

Regarding intraday strategies in the crypto market, I will continue to focus on large pullbacks in Bitcoin and Ethereum, anticipating the continuation of a mid-term bullish market trend, which remains intact.

For short-term trading, the strategy and conditions are outlined below.

Scenario #1: I plan to buy Bitcoin today upon reaching the entry point around $83,400, targeting a rise to $84,800. Around $84,800, I will exit long positions and sell immediately on the bounce. Before entering a breakout trade, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Bitcoin is also possible from the lower boundary at $82,800 if there is no market reaction to a breakout. Aim for a rebound to $83,400 and $84,800.

Scenario #1: I plan to sell Bitcoin today upon reaching the entry point of around $82,800, targeting a decline to $81,500. Around $81,500, I will exit short positions and buy immediately on the bounce. Before entering a breakout trade, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Bitcoin is also possible from the upper boundary at $83,400 if there is no market reaction to a breakout, aiming for a decline to $82,800 and $81,500.

Scenario #1: I plan to buy Ethereum today upon reaching the entry point around $1,817, targeting a rise to $1,857. Around $1,857, I will exit long positions and sell immediately on the bounce. Before entering a breakout trade, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Ethereum is also possible from the lower boundary at $1,790 if there is no market reaction to a breakout. Aim for a rebound to $1,817 and $1,857.

Scenario #1: I plan to sell Ethereum today upon reaching the entry point of around $1,790, targeting a decline to $1,750. Around $1,750, I will exit short positions and buy immediately on the bounce. Before entering a breakout trade, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Ethereum is also possible from the upper boundary at $1,817 if there is no market reaction to a breakout, aiming for a decline to $1,790 and $1,750.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pola gelombang pada grafik 4 jam untuk BTC/USD menjadi agak lebih kompleks. Kami mengamati struktur korektif ke bawah yang menyelesaikan formasinya di sekitar angka $75,000. Setelah itu, pergerakan naik yang

Kemarin bitcoin mengalami rally yang kuat. Setelah menembus level $90.000, cryptocurrency terkemuka ini melonjak menuju $94.000, tempat kenaikan tersebut sementara terhenti. Ether juga mencatatkan kenaikan yang mengesankan. Setelah diperdagangkan

Bitcoin berhasil menembus di atas $90.000, sementara Ethereum naik lebih dari 10% hanya dalam satu hari, kembali ke $1.800. Yang menjadi katalis utama adalah pernyataan Donald Trump kemarin, yang menjelaskan

Bitcoin Kembali ke Zona $88.000, tetapi Ethereum Menghadapi Tantangan Penjualan kemarin selama sesi AS, kembali dipicu oleh penurunan indeks saham Amerika, yang diimbangi oleh pembeli Bitcoin, sementara Ethereum hanya sedikit

Bitcoin dan Ethereum, setelah menghabiskan seluruh akhir pekan bergerak menyamping dalam rentang tertentu, melonjak tajam selama sesi Asia hari ini. Kenaikan ini dipicu oleh rumor bahwa Ketua Federal Reserve

Setelah berhasil keluar dari pola Ascending Broadening Wedge di chart 4 jamnya mata uang kripto Litecoin yang diikuti oleh munculnya Divergence antara pergerakan harga Litecoin dengan indikator Stochastic Oscillator serta

Tekanan pada pasar cryptocurrency kembali muncul kemarin setelah para trader dan investor memicu aksi jual di pasar saham AS. Seperti yang telah saya nyatakan berulang kali, korelasi antara kedua pasar

Bitcoin memperkuat posisinya dengan cukup baik, hampir mencapai level 86.000. Ethereum juga menunjukkan kenaikan, tetapi kehilangan keunggulan tersebut pada akhir sesi perdagangan di AS. Dengan meredanya ketegangan terkait tarif

Selama akhir pekan lalu, Bitcoin dan Ethereum menunjukkan ketahanan yang cukup baik, mempertahankan peluang untuk terus pulih. Meskipun dari sudut pandang teknikal peluang tersebut mungkin tampak agak tipis, trading dalam

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.