Lihat juga

27.03.2025 06:53 PM

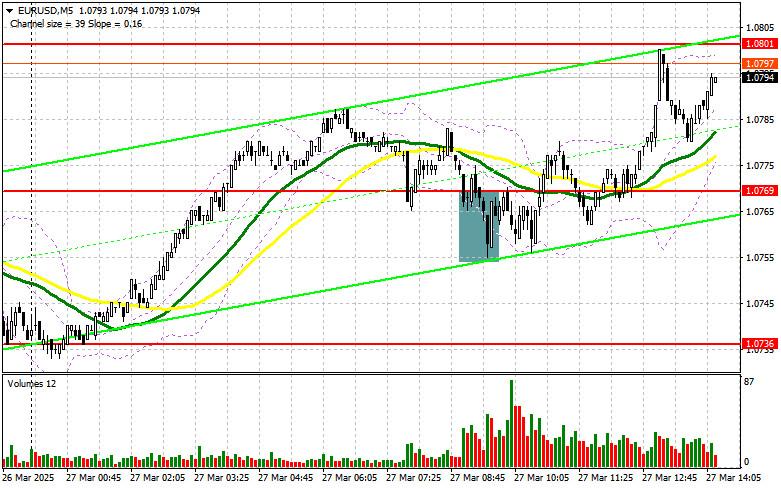

27.03.2025 06:53 PMIn my morning forecast, I focused on the 1.0769 level and planned to make trading decisions based on it. Let's take a look at the 5-minute chart and see what happened. The pair declined and formed a false breakout around 1.0769, which allowed for entry into long positions, but no significant upward movement followed. The technical picture for the second half of the day remains unchanged.

Considering that all bearish attempts to pressure the euro have failed, there is a chance for the pair to recover in the second half of the day — but this will require weak U.S. data. Lending figures from the eurozone were relatively decent, which also helped the euro recover slightly. During the U.S. session, only a significant downward revision of final Q4 U.S. GDP data will trigger new euro purchases and dollar sales. Additionally, the release of the core Personal Consumption Expenditures (PCE) index and weekly jobless claims will draw even more attention. FOMC member Thomas Barkin's speech will wrap up the day.

If the euro drops again, only a false breakout around the 1.0769 support — which acted as resistance earlier today — will provide a reason to buy EUR/USD in anticipation of a bullish trend, with the target of retesting 1.0801. A breakout and retest of this range from above will confirm the correct entry point for buying, with a move toward 1.0830. The final target will be the 1.0860 area, where I will take profit.

If EUR/USD drops and shows no signs of bullish activity around 1.0769 (which is more likely), the pair may continue to correct lower. In that case, only a false breakout around 1.0736 will justify buying the euro. I plan to open long positions immediately on a rebound from 1.0691 with a short-term correction target of 30–35 points.

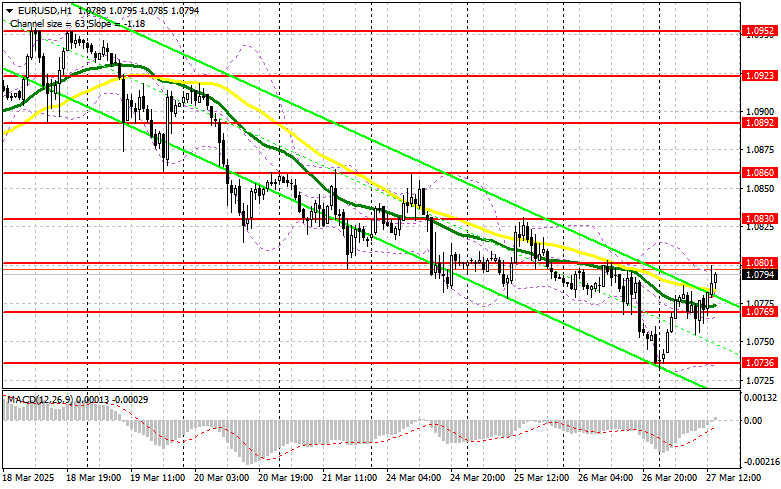

Sellers have stepped aside for now after yesterday's sell-off triggered by Donald Trump's tariff announcements. Only very strong U.S. GDP and labor market data can bring back demand for the dollar. A false breakout around 1.0801 will allow short positions to be opened with a target at the 1.0769 support level, where the moving averages currently support the sellers. A breakout and consolidation below this range will open the way toward 1.0736. The final target will be 1.0691, where I plan to take profit.

If EUR/USD moves higher during the second half of the day and bears do not act around 1.0801, buyers may push the pair further up. In that case, I will delay short positions until a test of the next resistance at 1.0830. I will sell there only after a failed consolidation. If there is no downward movement from that level either, I will look for shorts around 1.0860, targeting a 30–35 point correction.

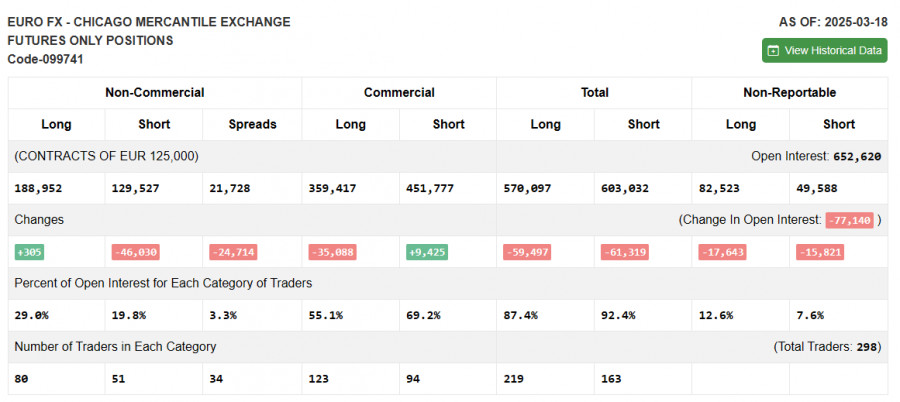

The March 18 COT report showed an increase in long positions and a significant reduction in shorts. Interest in buying the euro is growing, while sellers continue to exit the market. The ECB's cautious stance on rate cuts and weak U.S. fundamentals, pushing the Fed toward a more dovish policy, are shifting market sentiment.

According to the COT report, long non-commercial positions rose by 305 to 188,952 and short non-commercial positions fell by 46,030 to 129,527. The gap between longs and shorts narrowed by 24,714

Indicator Signals:

Moving Averages Trading is occurring near the 30- and 50-period moving averages, indicating a sideways market.

Note: The author uses H1 chart periods and prices, which differ from classic daily moving averages on D1.

Bollinger Bands In case of a decline, the lower boundary of the indicator around 1.0736 will act as support.

Indicator Descriptions:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Dalam prediksi pagi saya, saya menyoroti level 1,3247 sebagai titik acuan untuk keputusan memasuki pasar. Mari kita lihat grafik 5 menit dan menganalisis apa yang terjadi. Pasangan mata uang memang

Dalam prediksi pagi, saya menyoroti level 1,1341 sebagai titik kunci untuk keputusan masuk pasar. Mari perhatikan grafik 5 menit dan analisis apa yang terjadi di sana. Penurunan diikuti oleh false

Sepanjang hari Selasa, pasangan GBP/USD terus bergerak naik. Seperti yang kita lihat, mata uang Inggris tidak memerlukan alasan khusus untuk terus naik. Kami telah beberapa kali mengatakan bahwa saat

Pada hari Selasa, pasangan mata uang EUR/USD mengalami sedikit penurunan, yang dapat dianggap sebagai koreksi teknis murni. Kemarin — dan secara umum — dolar masih belum memiliki alasan nyata untuk

Pada hari Selasa, pasangan mata uang GBP/USD melanjutkan pergerakan naiknya hampir sepanjang hari. Tidak ada alasan signifikan atau dasar fundamental untuk ini, tetapi seluruh pasar mata uang bergerak secara acak

Pada hari Selasa, pasangan mata uang EUR/USD memulai penurunan yang telah lama dinantikan, meskipun tidak jatuh terlalu jauh atau terlalu lama. Perlu diingat bahwa tidak ada alasan fundamental untuk pertumbuhan

Dalam perkiraan pagi saya, saya fokus pada level 1.3204 dan merencanakan untuk membuat keputusan trading dari level tersebut. Mari kita lihat grafik 5 menit dan lihat apa yang terjadi. Terjadi

Dalam prediksi pagi, saya menyoroti level 1,1377 dan merencanakan untuk membuat keputusan trading dari sana. Mari perhatikan grafik 5 menit dan analisis apa yang terjadi. Kenaikan diikuti oleh false breakout

Pada hari Senin, pasangan GBP/USD melanjutkan pergerakan naiknya tanpa kesulitan. Tidak ada alasan makroekonomi untuk ini, dan bahkan euro menunjukkan pergerakan yang jauh lebih tenang pada akhir hari. Namun, pound

Pada hari Senin, pasangan mata uang EUR/USD lebih banyak diperdagangkan secara mendatar daripada naik, meskipun pada akhirnya tetap mengalami kenaikan nilai. Tidak ada peristiwa makroekonomi atau fundamental besar yang dijadwalkan

Indikator pola

grafis.

Lihat hal-hal

yang belum pernah anda lihat!

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.