spot.BDSXTST ( vs ). Exchange rate and online charts.

Currency converter

06 Mar 2024 07:10

(-0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

See Also

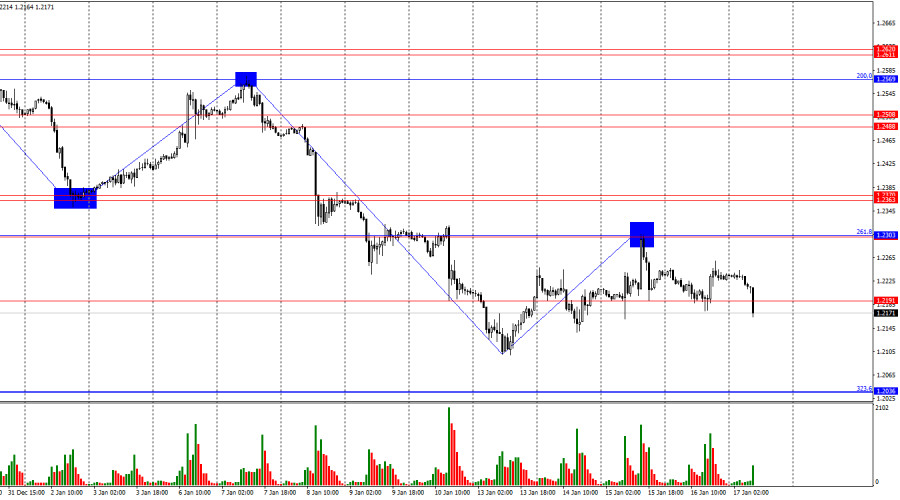

- The test of the 1.2220 price level during the first half of the day coincided with the MACD indicator already moving significantly below the zero mark

Author: Jakub Novak

12:57 2025-01-17 UTC+2

1198

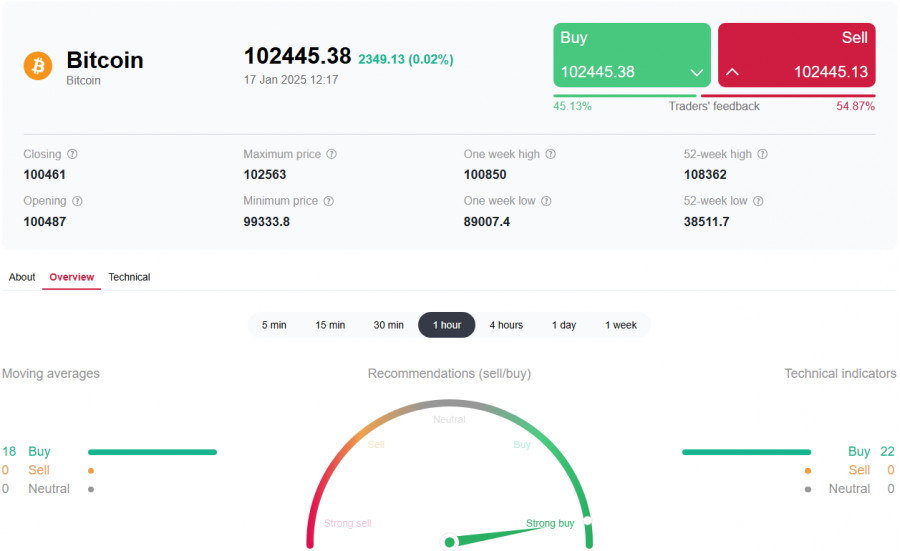

The fundamental outlook for Bitcoin and major altcoins remains bullish.Author: Jurij Tolin

16:27 2025-01-17 UTC+2

1168

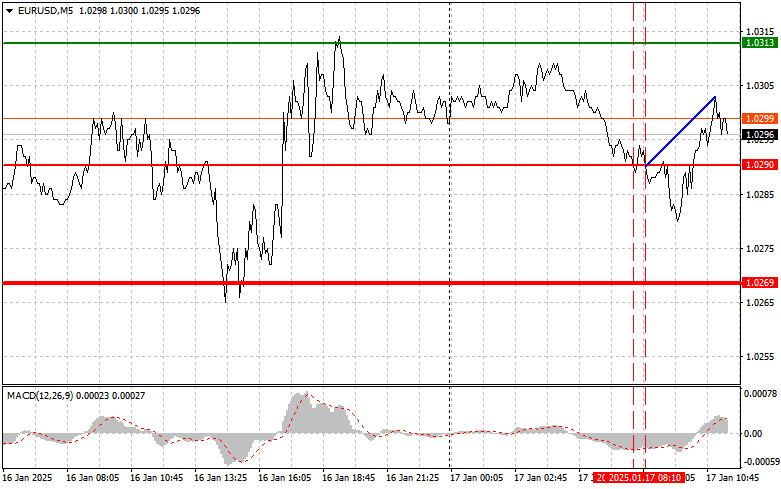

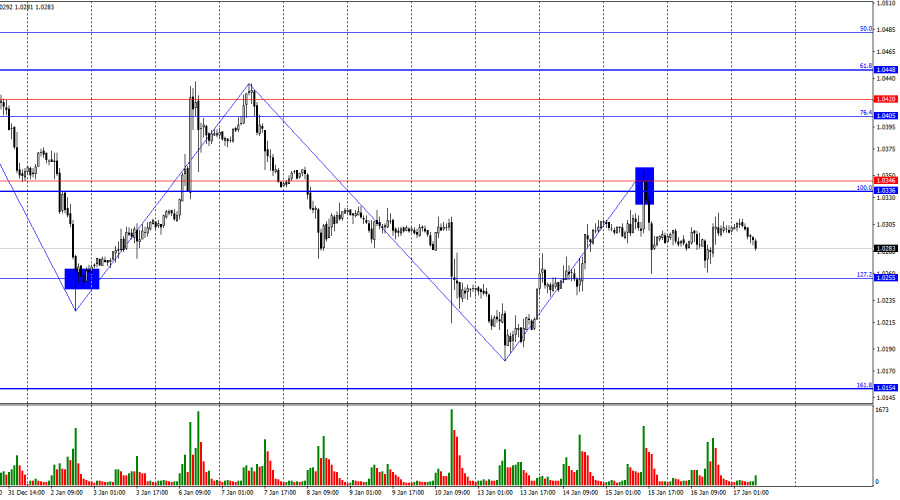

The first test of the 1.0290 price occurred when the MACD indicator had already moved far below the zero markAuthor: Jakub Novak

12:53 2025-01-17 UTC+2

1153

- Bullish traders continue to retreat

Author: Samir Klishi

12:43 2025-01-17 UTC+2

1123

Technical analysisTrading Signals for EUR/USD for January 16-19, 2025: buy above 1.0290 (21 SMA - 4/8 Murray)

The key is to stay alert. If the EUR/USD pair manages to consolidate above the 200 EMA, we could expect a trend change so that the euro could continue its rise until reaching the 1.0742 area (8/8 Murray).Author: Dimitrios Zappas

14:57 2025-01-17 UTC+2

1108

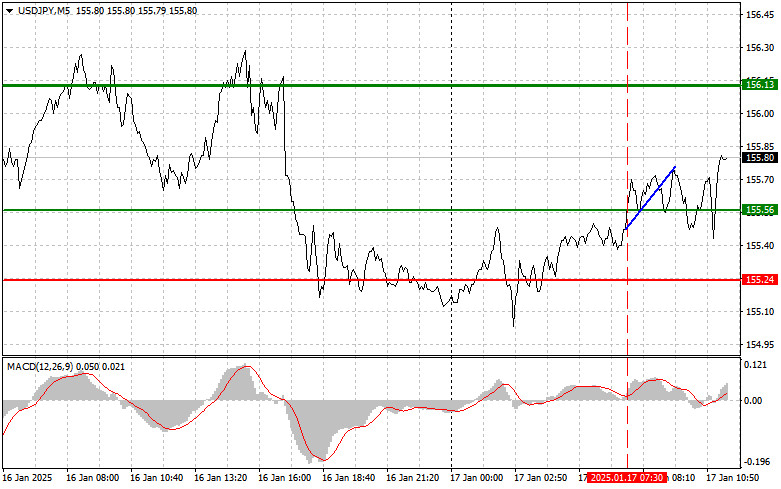

The test of the 155.56 price level coincided with the MACD indicator just starting to move upward from the zero markAuthor: Jakub Novak

13:00 2025-01-17 UTC+2

1093

- Technical analysis / Video analytics

Forex forecast 17/01/2025: EUR/USD, GBP/USD, Gold, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, Gold, Oil and BitcoinAuthor: Sebastian Seliga

11:47 2025-01-17 UTC+2

1093

The EUR/USD pair struggled to maintain support for bulls as bears continued to profitAuthor: Samir Klishi

14:45 2025-01-17 UTC+2

1018

The Japanese yen is declining, giving up part of its strong weekly gains against the US dollarAuthor: Irina Yanina

12:35 2025-01-17 UTC+2

988

- The test of the 1.2220 price level during the first half of the day coincided with the MACD indicator already moving significantly below the zero mark

Author: Jakub Novak

12:57 2025-01-17 UTC+2

1198

- The fundamental outlook for Bitcoin and major altcoins remains bullish.

Author: Jurij Tolin

16:27 2025-01-17 UTC+2

1168

- The first test of the 1.0290 price occurred when the MACD indicator had already moved far below the zero mark

Author: Jakub Novak

12:53 2025-01-17 UTC+2

1153

- Bullish traders continue to retreat

Author: Samir Klishi

12:43 2025-01-17 UTC+2

1123

- Technical analysis

Trading Signals for EUR/USD for January 16-19, 2025: buy above 1.0290 (21 SMA - 4/8 Murray)

The key is to stay alert. If the EUR/USD pair manages to consolidate above the 200 EMA, we could expect a trend change so that the euro could continue its rise until reaching the 1.0742 area (8/8 Murray).Author: Dimitrios Zappas

14:57 2025-01-17 UTC+2

1108

- The test of the 155.56 price level coincided with the MACD indicator just starting to move upward from the zero mark

Author: Jakub Novak

13:00 2025-01-17 UTC+2

1093

- Technical analysis / Video analytics

Forex forecast 17/01/2025: EUR/USD, GBP/USD, Gold, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, Gold, Oil and BitcoinAuthor: Sebastian Seliga

11:47 2025-01-17 UTC+2

1093

- The EUR/USD pair struggled to maintain support for bulls as bears continued to profit

Author: Samir Klishi

14:45 2025-01-17 UTC+2

1018

- The Japanese yen is declining, giving up part of its strong weekly gains against the US dollar

Author: Irina Yanina

12:35 2025-01-17 UTC+2

988