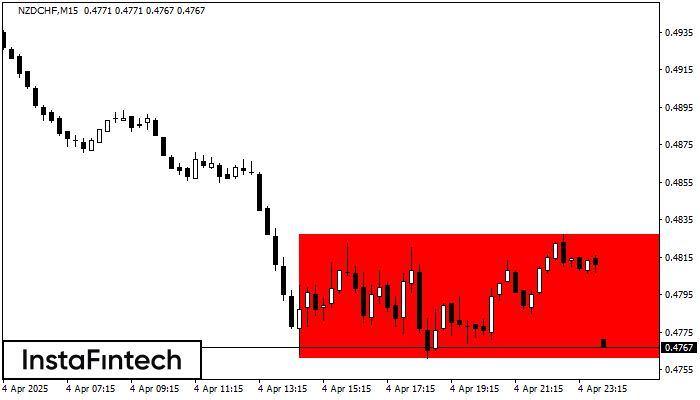

Bearish Rectangle

was formed on 06.04 at 23:00:12 (UTC+0)

signal strength 2 of 5

According to the chart of M15, NZDCHF formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 0.4827, the lower border is 0.4761. The signal means that a short position should be opened after fixing a price below the lower border 0.4761 of the Bearish Rectangle.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

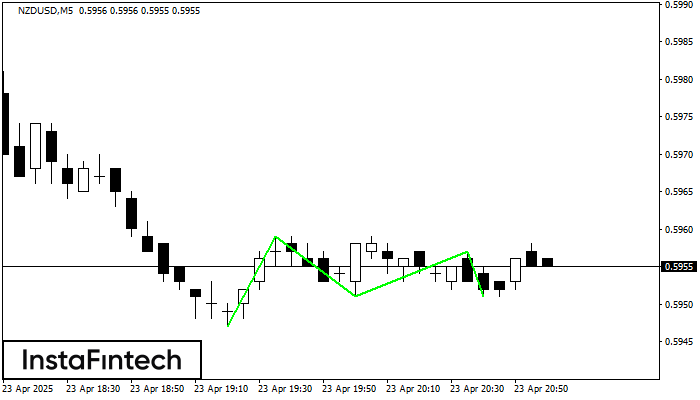

Triple Bottom

was formed on 23.04 at 20:00:49 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has been formed on NZDUSD M5. It has the following characteristics: resistance level 0.5959/0.5957; support level 0.5947/0.5951; the width is 12 points. In the event

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

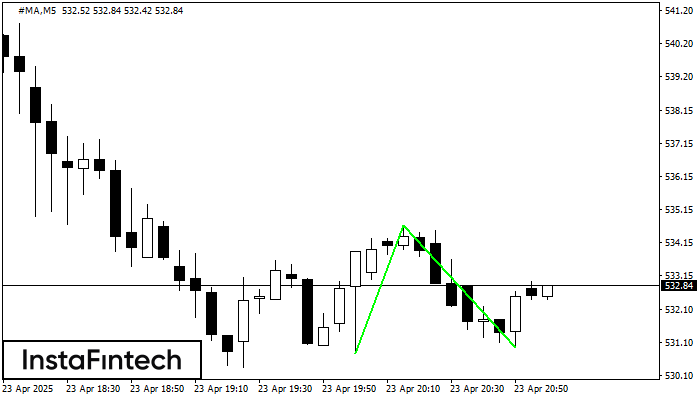

Double Bottom

was formed on 23.04 at 20:00:30 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on #MA M5. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

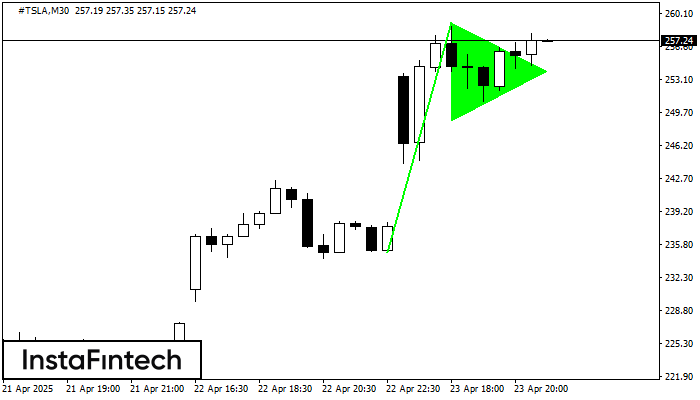

Bullish pennant

was formed on 23.04 at 20:00:19 (UTC+0)

signal strength 3 of 5

The Bullish pennant graphic pattern has formed on the #TSLA M30 instrument. This pattern type falls under the category of continuation patterns. In this case, if the quote can breaks

Open chart in a new window