See also

16.04.2025 07:03 AM

16.04.2025 07:03 AMOn Tuesday, the EUR/USD currency pair pulled back slightly, which can be considered a purely technical correction. Yesterday — and generally — the dollar still has no real reason to strengthen, given the current fundamental backdrop and how the market interprets it. Right now, the market only responds to news about the trade war. If there's news — the dollar falls. If there's no news, it usually moves sideways or stays flat, as we've seen over the past few days.

We still believe the market ignores many dollar-supportive factors because the U.S. economy remains stronger than the European or British economies. Yes, its outlook under Trump is uncertain, but things aren't any better in Europe or the UK since the trade war also affects them. However, the market seems to respond directly to Trump's protectionist policies by selling the dollar, U.S. stocks, and bonds.

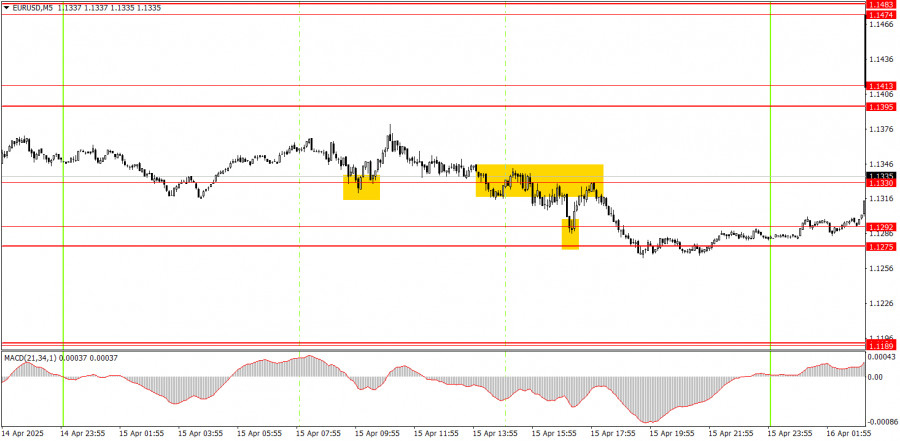

Several trading signals were formed on Tuesday's 5-minute time frame, but the movements remained random and chaotic. We've mentioned this several times before. Of course, signals still occur, but they're not playing out reliably, and the pair only shows good movement when Trump introduces new tariffs or raises existing ones.

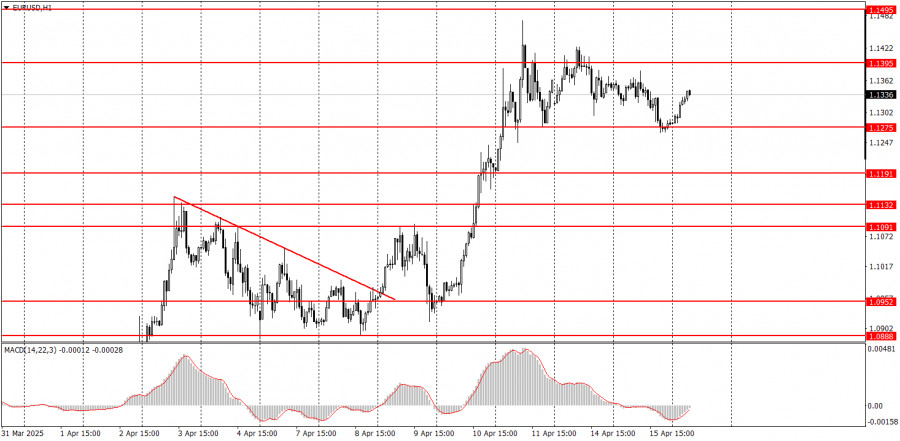

The EUR/USD pair continues its upward trend on the hourly time frame. It is unknown how long this trend will last, as no one knows how many additional tariffs Trump may impose. Escalation of the trade war is entirely possible, as many countries are planning reciprocal actions — something the U.S. president is unlikely to appreciate. Because of Trump's "concessions," the dollar hasn't been able to strengthen, and now the focus is on the U.S.–China trade confrontation, where there are no positive developments.

On Wednesday, the markets will likely remain in a state of panic. We won't attempt to forecast price movements since trade-related news can drop anytime. This means the price could suddenly spike in either direction.

On the 5-minute TF, the levels of 1.0797-1.0804, 1.0859-1.0861, 1.0888-1.0896, 1.0940-1.0952, 1.1011, 1.1091, 1.1132-1.1140, 1.1189-1.1191, 1.1275-1.1292, 1.1330, 1.1395-1.1413, 1.1474-1.1483 should be considered. On Wednesday, the eurozone will publish the second inflation estimate, and the U.S. will release reports on retail sales and industrial production. These are relatively secondary indicators, even if the inflation report looks significant at first glance. Still, this is only a second estimate — and the euro continues to rise even amid ongoing ECB monetary easing.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade higher throughout Thursday. Even at its peak levels, the British pound shows no intention of correcting

Analysis of Thursday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued trading within a sideways channel on Thursday, as shown on the hourly timeframe chart above. The current

The GBP/USD currency pair continued its upward movement on Thursday, trading near multi-year highs. Despite the lack of significant events in the U.S. or the U.K. (unlike Wednesday), the market

The EUR/USD currency pair continued to trade sideways on Thursday. While previously it had been moving within a range between 1.1274 and 1.1391, on Thursday, it was stuck

In my morning forecast, I highlighted the 1.3247 level as a reference point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened

In my morning forecast, I highlighted the 1.1341 level as a key point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened there

Analysis of Tuesday's Trades 1H Chart of GBP/USD Throughout Tuesday, the GBP/USD pair continued its upward movement. As we can see, the British currency doesn't need any particular reason

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.