See also

15.04.2025 06:29 AM

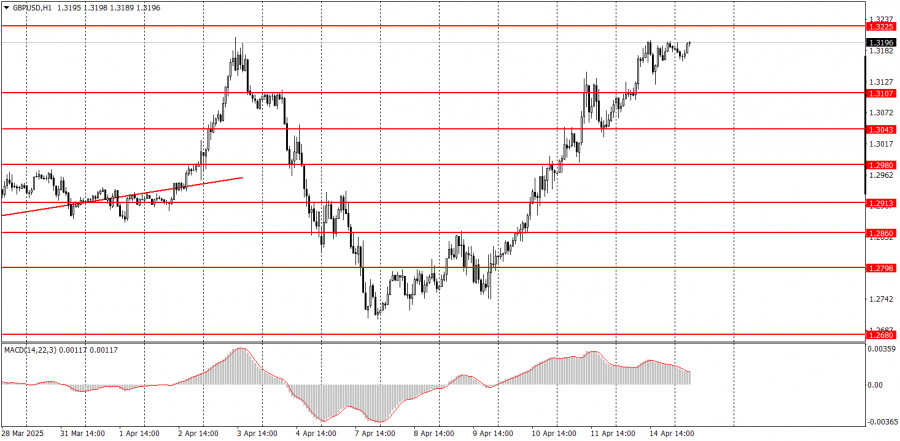

15.04.2025 06:29 AMOn Monday, the GBP/USD pair continued its upward movement without any trouble. There were no macroeconomic reasons for this, and even the euro showed much more subdued movement by the end of the day. However, the British pound became more active on Monday after Donald Trump announced new tariffs and simultaneously denied his weekend statements about exempting certain types of electronics from import duties in the U.S. As we can see, nothing has changed. The U.S. president continues to escalate tensions worldwide, making decisions one day and reversing them the next. Consequently, the dollar has little reason to strengthen, although the market could enter a correction at any time. One should not blindly buy the pair every day based on a single factor. We believe market behavior like this is much more dangerous for traders than calm movement within a narrow range. Traders need a trend—but one that is calm, understandable, and technical.

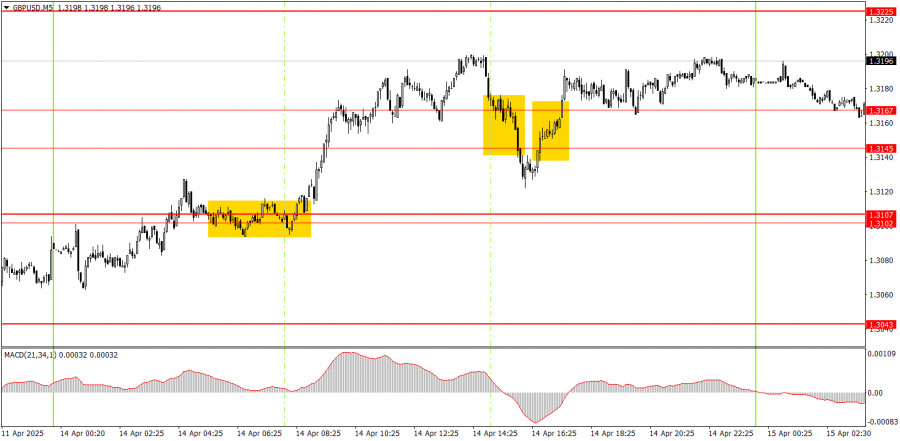

Only the first buy signal near the 1.3102–1.3107 area in the 5-minute timeframe was noteworthy on Monday. After it formed, the price moved upward by around 80 pips, and then chaos followed, with all levels and zones completely ignored. This is a reminder for novice traders that movements are currently chaotic, erratic, and far less technical than usual.

In the one-hour timeframe, the GBP/USD pair should have started a downtrend long ago, but Trump continues to do everything to push the dollar lower. Since the official beginning of the global trade war, we've refrained from forecasting long-term price movements. The market remains under the control of Trump and his decisions. Trump announces new tariffs—the dollar falls again. Trump raises tariffs—the dollar falls again. Even a pause in escalation results in a flat market, or... the dollar still falls.

On Tuesday, GBP/USD may remain in stormy conditions. Predicting where the pound and the dollar will move today is nearly impossible. The pair is rising logically at the moment, but no one knows what news — and when — might come from Beijing, Brussels, or Washington.

On the 5-minute TF, you can now trade at 1,2502-1,2508, 1,2547, 1,2613, 1,2680-1,2685, 1,2723, 1,2791-1,2798, 1,2848-1,2860, 1,2913, 1,2980-1,2993, 1,3043, 1,3102-1,3107, 1,3145-1,3167, 1,3225, 1,3272. On Tuesday, the UK is scheduled to release reports on unemployment, jobless claims, and wages. While this is interesting data, it's unlikely to have much influence on the market under current conditions.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade higher throughout Thursday. Even at its peak levels, the British pound shows no intention of correcting

Analysis of Thursday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued trading within a sideways channel on Thursday, as shown on the hourly timeframe chart above. The current

The GBP/USD currency pair continued its upward movement on Thursday, trading near multi-year highs. Despite the lack of significant events in the U.S. or the U.K. (unlike Wednesday), the market

The EUR/USD currency pair continued to trade sideways on Thursday. While previously it had been moving within a range between 1.1274 and 1.1391, on Thursday, it was stuck

In my morning forecast, I highlighted the 1.3247 level as a reference point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened

In my morning forecast, I highlighted the 1.1341 level as a key point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened there

Analysis of Tuesday's Trades 1H Chart of GBP/USD Throughout Tuesday, the GBP/USD pair continued its upward movement. As we can see, the British currency doesn't need any particular reason

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair pulled back slightly, which can be considered a purely technical correction. Yesterday — and generally —

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.