See also

02.04.2025 11:19 AM

02.04.2025 11:19 AMFollowing yesterday's regular session, US stock indices closed mixed. The S&P 500 rose by 0.38%, while the Nasdaq 100 gained 0.87%. The industrial Dow Jones dipped by 0.04%.

Asian indices declined today as traders took a wait-and-see approach ahead of President Donald Trump's announcement of severe tariffs. The yield on 10-year US Treasury bonds rose after a three-day decline, as traders weighed the likelihood of a dovish shift in the Federal Reserve's policy. Futures for US and European stock indices opened today lower, which also signals risks of a sharp response to Trump's actions. The US dollar was little changed against major currencies, while gold traded just below its record high.

Discussions on Trump's plans to impose reciprocal tariffs are nearing completion, with his team reportedly still working out the size and scope of the new tariffs he is expected to announce today. This unpredictability has already shaken the markets, prompting economists to downgrade their global growth forecasts. Central banks have to factor in the potential inflationary impact of import costs. The tariffs will take effect immediately after the announcement at an event scheduled for 4:00 PM New York time.

Overall, the market saw a calm trading session, although there was some nervousness. Trump is planning to introduce so-called reciprocal tariffs and other levies, which he believes will be a "Day of Liberation"—a move expected to impact a broader area of global trade.

Meanwhile, President of the Chicago Federal Reserve Bank Austan Goolsbee warned of the negative consequences of any slowdown in consumer spending or business investment due to the uncertainty surrounding tariffs. Governor of the Bank of Japan Kazuo Ueda also stated that US tariffs could have a significant impact on trade activity in affected countries.

However, some investors see an opportunity in the current situation. Moving some investments out of the US is a popular strategy. Trump's tariffs will open up huge investment opportunities in Europe. Managers at Goldman Sachs have even chosen the yen as the main hedging tool against a US recession and tariff-related risks.

As for commodities, the rally in the oil market observed last month has stalled, as traders prepare for the tariff announcement. Gold halted just one step away from its next historic high.

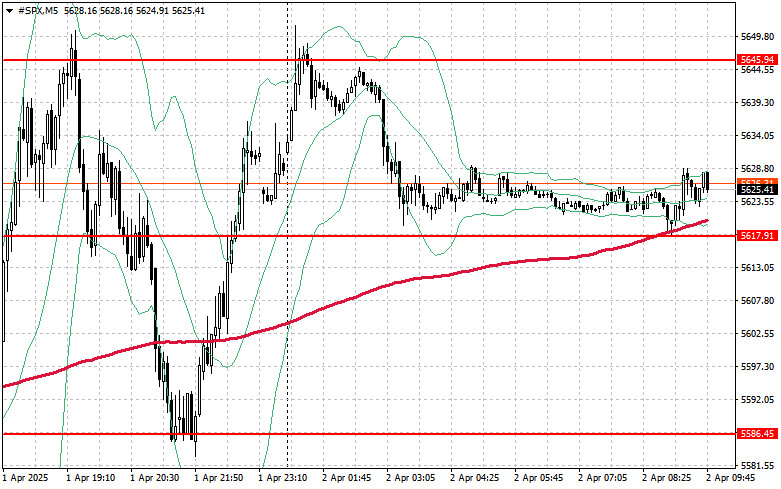

Regarding the technical outlook for the S&P 500, the index is still trading lower. The primary task for buyers today will be to overcome the nearest resistance at 5,645. This will help continue the rally and open up the possibility for a move to the next level at 5,670. Another priority for the bulls will be controlling the 5,692 level, which would strengthen their position. If there is a downward movement due to reduced risk appetite, buyers must step in around 5,617. A breakout would quickly push the trading instrument back to 5,585 and open the way to 5,552.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

At the close of the previous regular session, U.S. stock indices ended mixed. The S&P 500 gained 0.13%, while the Nasdaq 100 slipped 0.13%. The industrial Dow Jones dropped 1.33%

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.