See also

The USD/JPY pair is retreating from the psychological level of 151.00, reached earlier on Tuesday, though this pullback is not accompanied by significant selling pressure. The Japanese yen is attracting buyers amid hawkish comments from the Bank of Japan, despite disappointing PMI data from Japan.

According to the minutes of the Bank of Japan's January meeting, the need for further monetary tightening remains if positive economic prospects continue. BoJ Governor Kazuo Ueda emphasized that the goal is to achieve stable prices and that the bank is ready to adjust its policy if inflation reaches the 2% target. This fuels expectations that rising wages will impact inflation, supporting the case for higher interest rates.

However, hopes for less damaging U.S. trade tariffs, a peace agreement between Russia and Ukraine, and stimulus measures in China are holding traders back from aggressively betting on a stronger yen. Meanwhile, the U.S. dollar maintains its strength, supported by positive PMI data from the U.S., which also helps keep the USD/JPY pair elevated.

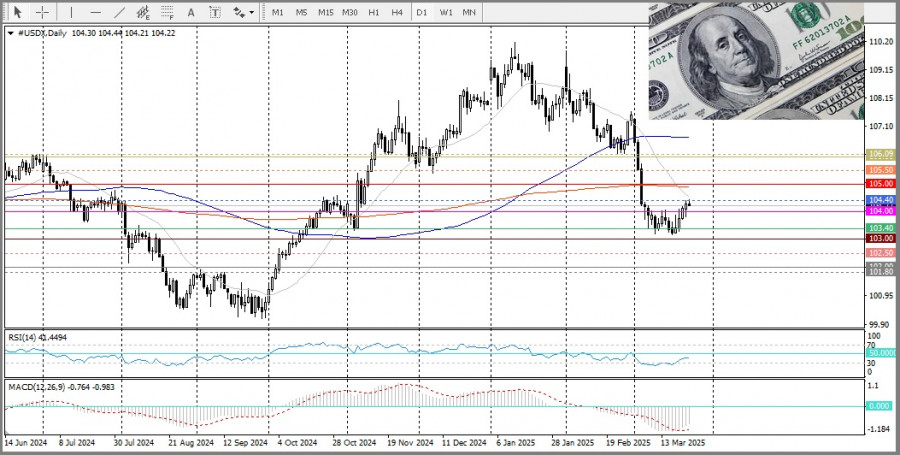

From a technical perspective, the breakout above the 150.00 level — coinciding with the 200-period Simple Moving Average (SMA) on the 4-hour chart — is seen as an important bullish signal.

A positive Relative Strength Index (RSI) on the daily chart supports the outlook for further gains. Pullbacks are likely to be viewed as buying opportunities, remaining limited by the psychological support at 150.00. However, a break below this level could open the path to support zones at 149.30–149.25 and lower. Failure to defend the 148.60 level would shift the short-term bias in favor of the bears.

If bullish traders can hold above 151.00, this may lead to a test of the monthly high around 151.30, followed by a move toward the 200-day SMA near 151.75, and then to the psychological level of 152.00. The rally could extend to intermediate resistance at 152.30 en route to the round level of 153.00.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.