See also

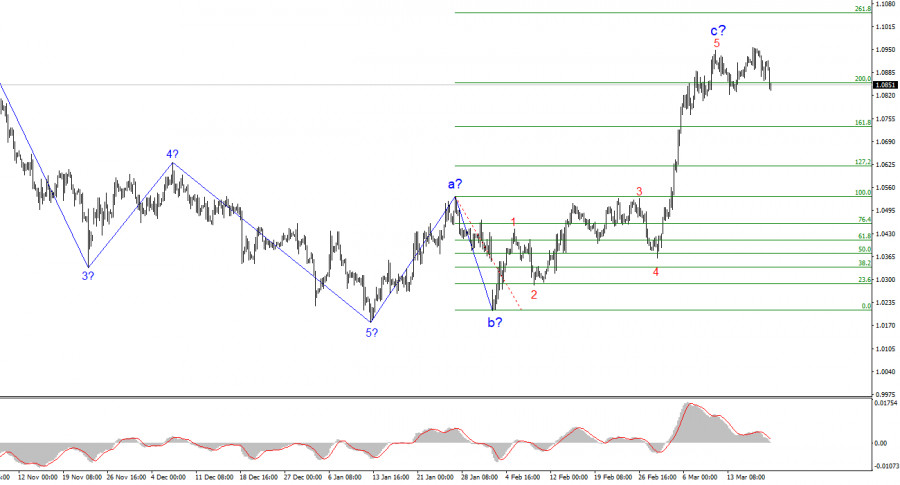

The wave structure on the 4-hour chart for EUR/USD is at risk of transforming into a more complex formation. A new downtrend structure started forming on September 25, which took on an impulse, five-wave shape. Two months ago, an upward corrective structure began developing, which should consist of at least three waves. The wave structure of the first corrective wave was well-formed, so I continue to expect the second wave to take on a clear shape as well. However, the size of this wave has already become so large that there is a risk of a significant transformation of the wave pattern.

The fundamental backdrop continues to favor sellers over buyers, at least when it comes to economic data. All recent U.S. reports indicate one thing only—the economy is not facing serious problems and shows no signs of slowing down to levels that would cause concern. However, the situation in the U.S. economy could change significantly in 2025, largely due to Donald Trump's policies. The Fed may cut rates multiple times, while tariffs and counter-tariffs could slow economic growth. If not for the latest developments, I would have maintained a 90% probability of further euro depreciation—but now, the outlook is more uncertain.

The EUR/USD pair fell by 60 basis points on Wednesday, but this move is too minor to confirm even a corrective wave. Despite the wave structure suggesting an end to the euro's rally, the market still refuses to increase demand for the U.S. dollar. The Fed meeting did nothing to change this.

Yesterday, I pointed out that the market had no problem selling the U.S. dollar despite strong U.S. economic growth and a hawkish Fed stance. Jerome Powell stated that there are no major economic issues in the U.S. and that the risk of recession remains the same as a year or two ago. In other words, the likelihood of a recession has not increased.

Given this, why would the market suddenly increase demand for the U.S. dollar if it didn't do so before? Nothing has changed in the economy or the Fed's expectations. The higher inflation forecasts only reinforce the belief that the Fed will continue to delay policy easing.

In my view, the dollar's fate is entirely in the hands of the market, not Donald Trump. The market interprets all available information and translates it into price action. Therefore, the content of the news is less important than how the market perceives it. And right now, the market firmly believes that Trump will push the U.S. economy into recession, which means that selling the dollar is the rational move.

At this point, it's difficult to see what could suddenly push the dollar to the 1.02–1.03 range, as suggested by the current wave structure.

Based on my analysis of EUR/USD, I conclude that the pair is still forming a downward trend segment, but this could soon reverse into an uptrend. The assumed second wave may be complete, but a new price increase could trigger a full transformation of the wave pattern. Since the fundamental backdrop contradicts the current wave structure, I cannot recommend selling EUR/USD—even though current levels look highly attractive for shorts if the wave pattern remains intact.

However, Donald Trump's policies could further weaken demand for the U.S. dollar, making the formation of a third wave downward unlikely.

On the higher wave scale, the structure has evolved into an impulse pattern. A new long-term downtrend wave sequence is likely, but the fundamental backdrop, especially influenced by Donald Trump, could turn everything upside down.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.