See also

US stock indices ended the day with solid gains. The S&P 500 climbed by 1.1% and the Nasdaq 100 closed 1.41% up.

At the moment, S&P 500 futures are up 0.5%. Nasdaq 100 futures have gained 0.7%. Hong Kong's Hang Seng has sunk by 1.5%. The Shanghai Composite dropped by 0.3%. Euro Stoxx 50 futures are trading flat.

Market optimism fueled by Fed's comments

The Wall Street indices rose after the Federal Reserve signaled that rate cuts are still on the table this year, as any inflationary impact from tariffs is expected to be temporary. The Fed's stance is likely to weaken the US dollar further, but at the same time, its policy shift could halt the bear market that has dominated Wall Street over the past month. As financial conditions ease, funds could begin flowing back into equities, further supporting the stock market rally.

China's market breaks the uptrend

Unlike global markets, China's stock market broke its uptrend, with the CSI 300 index declining for the first time in three days. Technology stocks were among the hardest hit. Meanwhile, Chinese government bonds rallied for a third straight day, following the central bank's increased short-term liquidity injections. The People's Bank of China added a total of 973.2 billion yuan in liquidity via short-term loans, marking the longest streak of injections since late January.

Key corporate news

Tencent Holdings Ltd. shares declined, despite reporting its fastest revenue growth since 2023. The drop came as investors were disappointed by the company's AI investment plans, which were less aggressive than expected. In South Korea, Samsung Electronics Co. shares rose after the company vowed to strengthen its market position in high-bandwidth memory chips, following shareholder criticism. Geely Automobile Holdings Ltd. reported better-than-expected annual profits, as the automaker boosted sales and cut costs to stay competitive in China's challenging auto market.

Powell's comments ease recession fears

Fed Chair Jerome Powell softened his stance on recession risks, helping calm investor sentiment. He stated that he does not strongly believe in an impending recession, reassuring many investors. However, the Fed's downward revision of economic growth forecasts triggered a bond market rally, as traders aligned their expectations with rate cuts later this year. Following the Fed's decision, Donald Trump criticized the central bank, stating that it should immediately cut interest rates, diverging from the Fed's current outlook.

Commodities surge amid market developments

Oil prices climbed after a US government report eased concerns over short-term demand disruptions. Gold hit a new all-time high, reflecting rising uncertainty in global markets. Copper prices surpassed $10,000 per ton, following weeks of market turmoil fueled by Trump's attempts to impose tariffs on the industrial metal.

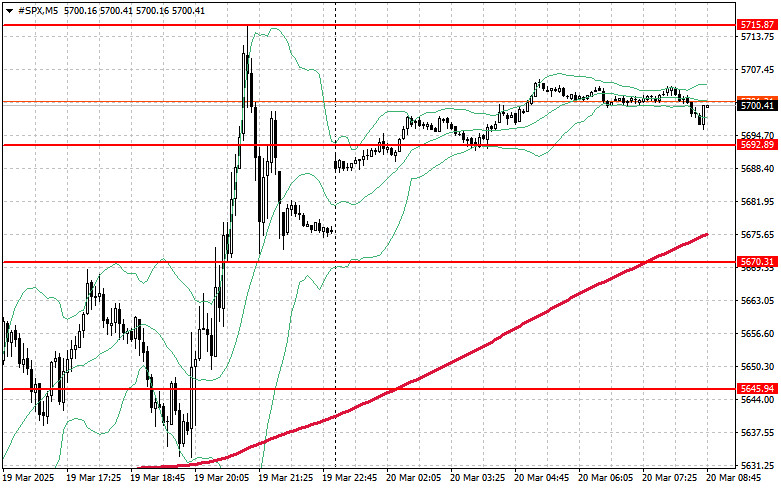

Technical outlook for S&P 500

The S&P 500 remains in a downtrend. Today, buyers' main challenge will be breaking through the nearest resistance at 5,715. A breakout above this level could extend the rally toward 5,740. Additionally, holding above 5,766 will be a key priority for bulls, reinforcing buying momentum. If risk appetite weakens, buyers must defend the 5,692 level. A break below could send the index quickly toward 5,645, opening the door for a further decline to 5,617.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.