See also

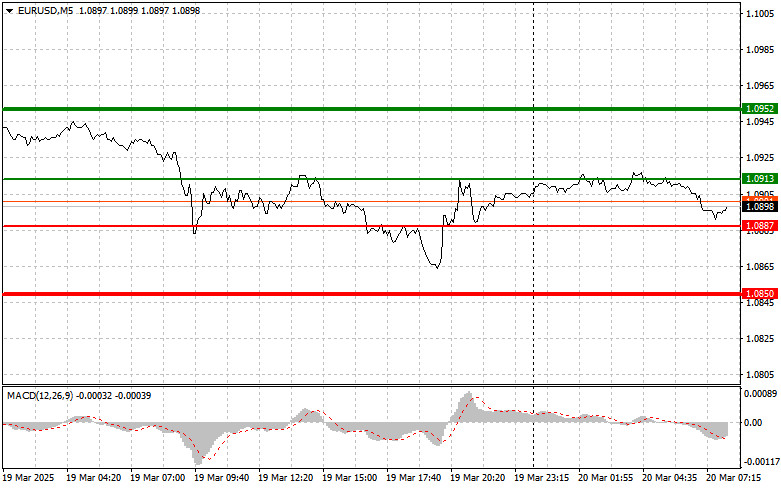

The price test at 1.0911 occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro. The second test of 1.0911, with the MACD in the overbought zone, led to the execution of Scenario No. 2 for selling, resulting in a decline of more than 30 pips.

Amid growing concerns about a U.S. economic slowdown and persistently high inflation, Federal Reserve officials decided to keep the key interest rate unchanged yesterday. However, this decision did not support the U.S. dollar, as under current conditions, high rates seem to exacerbate the dollar's problems and economic difficulties rather than solve them. The Federal Open Market Committee confirmed that the target range for the key interest rate would remain at 4.25% - 4.5% for the second consecutive meeting. This decision highlights the central bank's complex challenge—balancing the need to contain inflation while preventing further economic slowdown.

Despite this, the euro still has the potential for further growth. However, this scenario will depend on positive data from Germany's Producer Price Index and European Central Bank President Christine Lagarde's hawkish rhetoric. Investors closely analyze Germany's economic indicators, which serve as a key barometer of the eurozone's economic health. Lagarde's statements will also be crucial. If she hints at keeping interest rates unchanged for the foreseeable future, the euro may continue to rise—otherwise, the euro risks facing a downward correction.

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

Scenario No. 1: Today, I plan to buy the euro when the price reaches around 1.0913, with a target of 1.0952. At 1.0952, I intend to exit the market and sell the euro in the opposite direction, expecting a movement of 30-35 pips from the entry point. The euro's growth in the first half of the day can be expected to continue the upward trend following strong eurozone data. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario No. 2: I also plan to buy the euro if there are two consecutive tests of 1.0887 while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. A rise to the opposite levels of 1.0913 and 1.0952 can be expected.

Scenario No. 1: I plan to sell the euro after it reaches 1.0887, with a target of 1.0850. At this level, I will exit the market and buy in the opposite direction, expecting a movement of 20-25 pips in the reverse direction. Pressure on the pair could return today if Lagarde adopts a dovish stance. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario No. 2: I also plan to sell the euro if there are two consecutive tests of 1.0913 while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a downward market reversal. A decline toward 1.0887 and 1.0850 can be expected.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.