See also

18.03.2025 10:47 AM

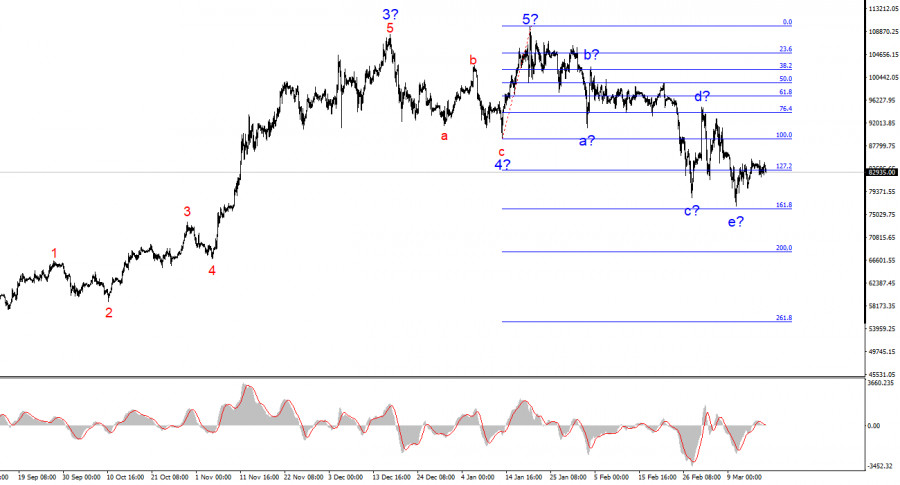

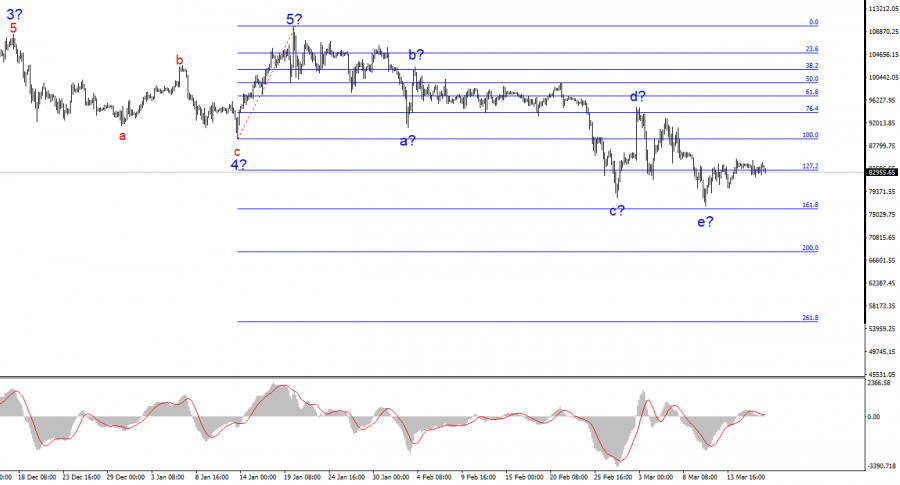

18.03.2025 10:47 AMThe 4-hour wave structure for BTC/USD appears clear and well-defined. After completing a five-wave bullish trend, a bearish phase began, which currently resembles a corrective pattern. Based on this, I do not expect Bitcoin to surpass $110,000 - $115,000 in the coming months.

Bitcoin's uptrend was supported by a steady flow of positive news regarding institutional investments, government purchases, and pension fund allocations. However, Trump's policies have driven investors out of the market, and no trend can remain bullish indefinitely.

The wave that started on January 20 does not resemble an impulse wave, suggesting we are dealing with a complex corrective structure that could last for months. The internal structure of this first wave is intricate, but I can identify a five-wave a-b-c-d-e pattern within it.

If the current wave analysis is correct, Bitcoin is now forming a corrective bullish wave, which, based on classical Elliott Wave theory, should consist of three waves.

BTC/USD has managed to halt its decline, and the current wave structure suggests a potential rise. However, this conclusion is based purely on technical wave analysis, as the fundamental backdrop remains bearish for Bitcoin, stocks, and other risk assets.

That said, it's crucial to remember that wave analysis does not control markets—it only highlights the most probable scenarios.

The price action over the past few days indicates a lack of buyers, which is another bearish signal. Additionally, the downward wave structure could evolve into an even more complex, extended pattern, surpassing the initial a-b-c-d-e formation.

Currently, Bitcoin appears to be slipping back toward the low of wave e, which leads me to believe that a three-wave correction may not materialize, and the downtrend could resume sooner than expected.

Analyzing the fundamental backdrop won't take much time—there are no major bullish developments that could justify a strong price surge.

Instead, we see a clear pattern. Since Donald Trump became U.S. president, Bitcoin has consistently lost value. This remains the primary bearish factor, and I expect it to continue pushing market participants toward selling Bitcoin.Based on my BTC/USD analysis, I conclude that Bitcoin's current growth phase is over. Everything suggests that we are in the early stages of a complex, multi-month correction.

I have not recommended buying Bitcoin before, and I certainly do not recommend it now.

A drop below the low of wave 4 would confirm that Bitcoin is entering a full-fledged bearish trend, likely of a corrective nature.

Therefore, I consider the best approach to be searching for short-selling opportunities. If a bullish correction occurs, I will look for selling opportunities with targets around $68,000 and lower.

On higher timeframes, Bitcoin has completed a five-wave bullish cycle and is now in the early stages of a corrective or full-scale bearish trend.

Key Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin and Ethereum dropped in value toward the end of Thursday's U.S. session but recovered during today's Asian trading hours. It has become common practice that the crypto market declined

With the appearance of divergence between the price movement of the Polkadot cryptocurrency and the Stochastic Oscillator indicator on its 4-hour chart, as long as there is no weakening correction

From what is seen on the 4-hour chart of the Uniswap cryptocurrency, there appears to be a divergence between the Uniswap price movement and the Stochastic Oscillator indicator, so based

Bitcoin and Ethereum collapsed by the end of Tuesday, continuing the heavy sell-off during today's Asian session. Another sharp decline in the U.S. stock market dragged other risk assets down

Ferrari F8 TRIBUTO

from InstaTrade

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.