See also

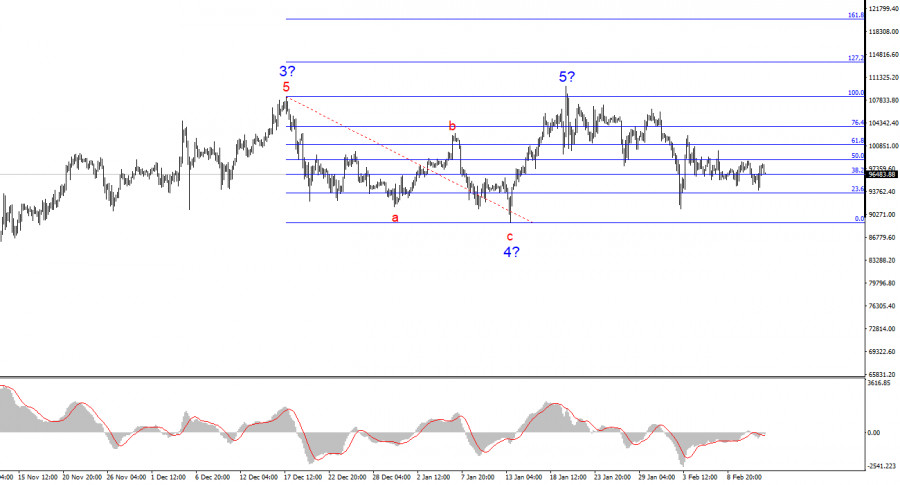

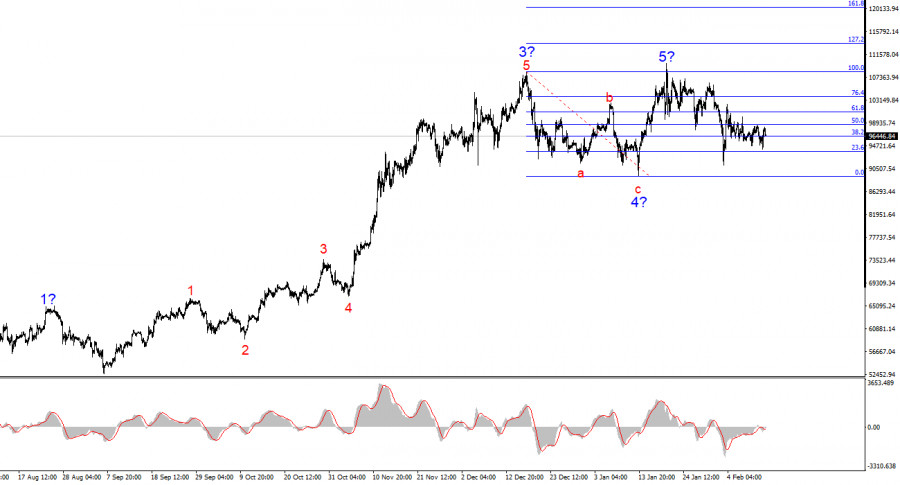

The wave structure on the 4-hour chart for BTC/USD remains clear and structured. Following a prolonged and complex corrective pattern (a-b-c-d-e) from March 14 to August 5, a new impulsive wave began forming, which has already taken a five-wave structure. Given the size of the first wave, the fifth wave may be truncated, leading me to believe that Bitcoin is unlikely to rise above $110,000–$115,000 in the coming months.

Additionally, wave 4 has taken on a three-wave pattern, confirming the accuracy of the current wave count. The fundamental backdrop has supported Bitcoin's growth due to continuous institutional investments, government interest, and pension fund involvement. However, Donald Trump's policies may push investors out of the market, and an uptrend cannot last indefinitely. The current structure of wave 2 within wave 5 raises doubts about whether it is indeed a valid wave 2, leading me to believe that the bullish phase is nearing completion.

BTC/USD gained $1,200 on Wednesday, but overall, Bitcoin continues to trade within a sideways range. Volatility has been unusually low over the past week, suggesting that the market is waiting for something big. However, it is not waiting for new data or news from Donald Trump—it is waiting for the moment when the next rally begins. This is a classic "calm before the storm" scenario.

I still find it difficult to expect a continued Bitcoin rally, even though many analysts and industry experts are anticipating one.

It's important to note that monetary policy from the Federal Reserve (Fed) plays a crucial role in Bitcoin's performance. When interest rates are high, Bitcoin loses its appeal as an investment, as bonds and bank deposits provide stable and relatively high returns while being safer assets. When interest rates are low, Bitcoin becomes more attractive, offering higher potential profits compared to traditional investments.

Even though the Fed is not planning to cut rates anytime soon, and possibly not at all in 2025, the tight monetary policy cycle has ended.

Bitcoin has rallied for two years in anticipation of future rate cuts, meaning this factor has already been priced in. As a result, I believe we should expect a complex corrective wave, leading to a significant pullback in Bitcoin and the broader crypto market.

However, the Fed's slow pace of policy adjustments has delayed the start of this correction.

Given that rate cuts are unlikely in the near future—which was confirmed by yesterday's U.S. inflation report—Bitcoin may continue consolidating within a sideways range. However, the wave structure suggests that we are currently witnessing the first of at least three corrective waves, which could push Bitcoin below $90,000.

Based on my BTC/USD analysis, I conclude that Bitcoin's rally is approaching its end.

This might be an unpopular opinion, but wave 5 may turn out to be truncated. If this assumption is correct, we are facing either a sharp decline or a prolonged correction.

For this reason, I do not recommend buying Bitcoin at this time. In the near future, Bitcoin could drop below the low of wave 4, confirming the transition into a bearish phase.

On a higher timeframe, the five-wave bullish structure is clearly visible. This suggests that a corrective downtrend is likely to begin soon.

Key Principles of My Analysis

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.