See also

Yesterday's drop in the euro and stock indexes is quite understandable given the escalation in the Middle East, but the historical example of the US-Iraq war in 2003, when the US stock market grew, warns us that it's too early to talk about a market reversal without confirming signs.

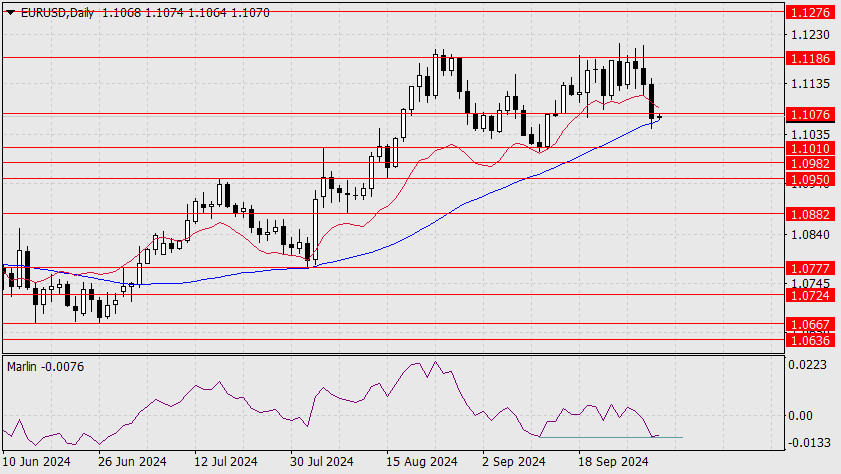

Yesterday's euro decline halted at the MACD line. The Marlin oscillator broke downward but also paused at the September 11 low. Closing today above the 1.1075 level could be a turning point toward the target level of 1.1276. The confirming reversal factor will be Marlin's move into positive territory. If the price consolidates below the MACD line, it will likely aim for the 1.1010 support level.

On the four-hour chart, the price settled below the 1.1076 level. The situation remains bearish, but the price might return above the breached level, as it didn't fall too far below it. Control over military actions will regain control over the market. We wait and watch.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.