See also

15.07.2024 10:56 AM

15.07.2024 10:56 AMGOLD

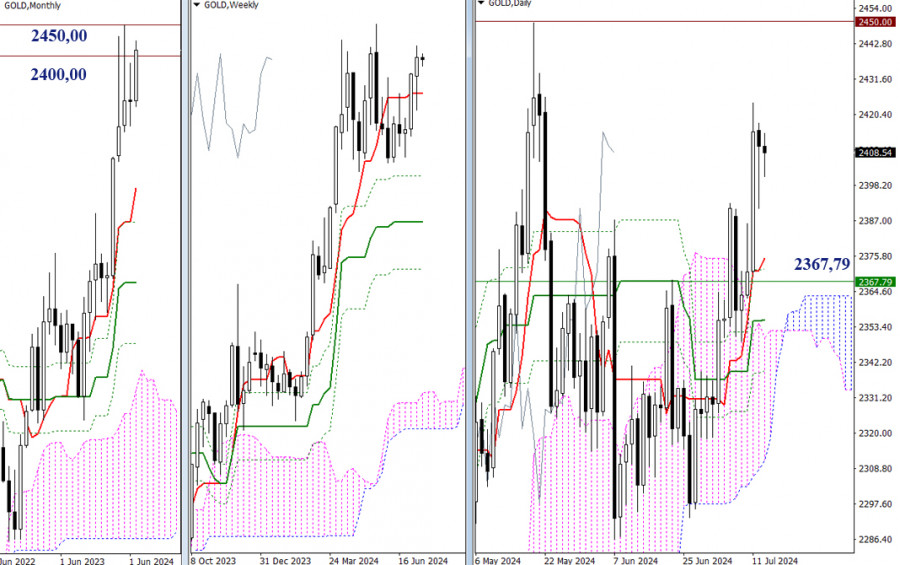

In April, gold reached and tested the psychological threshold of 2400.00. In May, the bulls made another attempt, and the trading instrument managed to rise to the area of 2450.00, but the result was similar to April's attempt. As a result, the two monthly candles have long upper shadows and this led to uncertainty in June. To change the situation and gain new prospects, the bulls must overcome the resistance at 2400.00 and 2450.00, firmly consolidating above these levels. The current influence, and containment of the situation in this part of the chart are currently also influenced by the weekly short-term trend (2367.79). Near the weekly trend and slightly below are the daily Ichimoku cross (2351.89 – 2444.24 – 2339.37 – 2326.84) and the daily Ichimoku cloud (2366.65 – 2303.11). It is necessary to break through the daily cross and cloud to further strengthen the bearish bias in the market.

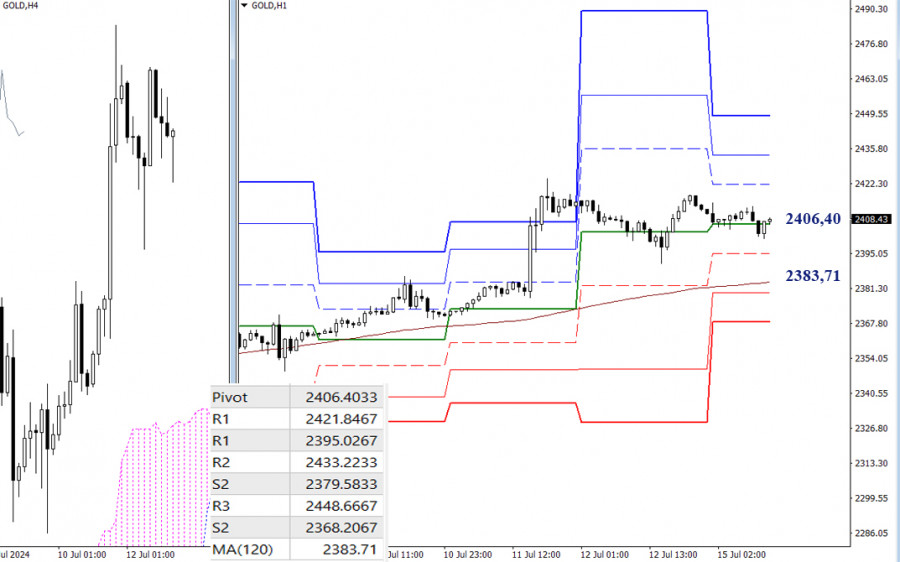

H4 – H1

On the lower timeframes, gold has long been in the area of the central Pivot level of the day (2406.40), which contributes to uncertainty. If the bulls manage to break free from the influence of the central Pivot level, the market's intraday focus will be on working out the resistances of the classic Pivot levels (2421.85 – 2433.22 – 2448.67). If the bears start to become more active, their first task will be to test and break the weekly long-term trend (2383.71), and then the focus will be on the supports of the classic Pivot levels (2379.58 – 2368.21).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

From what we see on the 4-hour chart of the Nasdaq 100 index, there are several interesting things, namely, first, the price movement is moving below the MA (100), second

Early in the American session, gold is trading around 3,312 with a bullish bias after breaking out of the symmetrical triangle. Gold is now likely to continue rising

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

On the 4-hour chart, the USD/CAD commodity currency pair can be seen moving below the EMA (100) and the appearance of a Bearish 123 pattern and the position

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.