See also

02.05.2024 01:41 AM

02.05.2024 01:41 AMApparently, the Japanese authorities did conduct a currency intervention on April 29th. The USD/JPY pair came close to the 160 mark, after which it quickly fell to 154.50.

A weak yen carries too many problems for the Japanese economy. Rapid currency depreciation leads to higher import costs, which, amid the threat of persistent inflation, may trigger a rise in domestic inflation in Japan in the second half of the year.

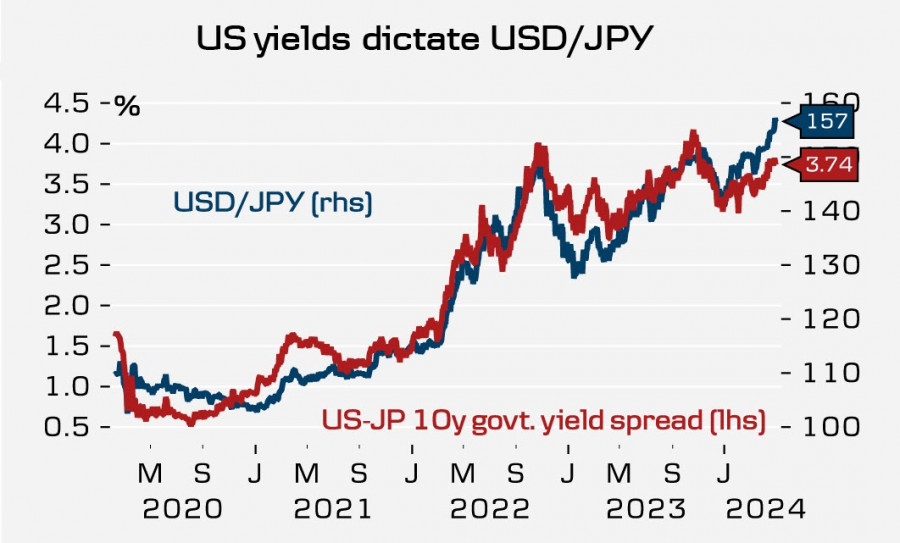

The main driver of the yen's weakness is the yield spread between US and Japanese bonds.

As the forecast for the Federal Reserve rate cut continues to shift further and further into 2025, and the Bank of Japan exhibits manic caution and hesitates to raise rates, any confirmation of this scenario will push USD/JPY higher, forcing Japanese authorities to intervene again and again. This will continue until the yield spread starts changing in the opposite direction.

However, this can only happen after the first Fed rate cut, and the further the rate forecast shifts, the stronger the pressure mounts on the yen.

As expected, the BOJ kept its monetary policy unchanged. Unlike the March meeting, where the decision was made to raise rates and end the yield curve control program, the decision was unanimous, indicating that the BOJ has paused while waiting for specific details from the Fed. New forecasts were also published, with the Bank expecting inflation to reach 2.1% by the fiscal year 2026. Markets interpret the forecast change as a decision to raise rates by 0.1% in the near future, but take note that there are no clear dates in the final statement or at the press conference.

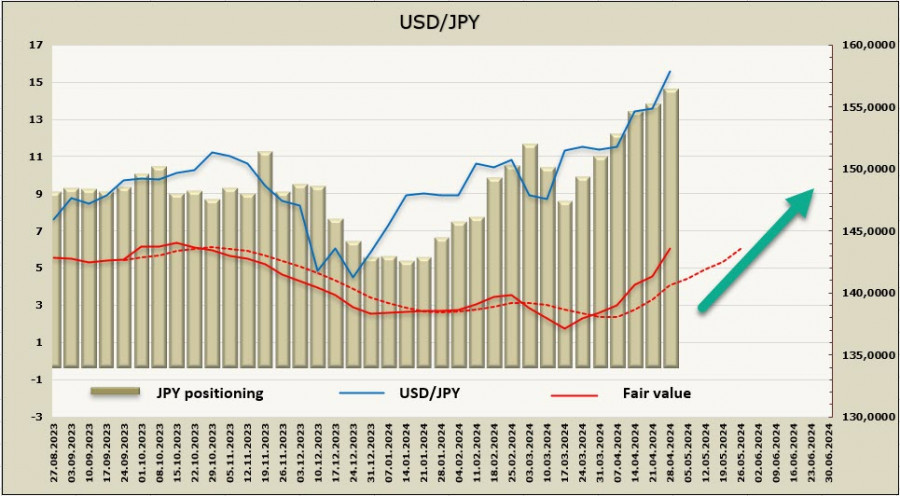

The net short JPY position increased by $1.15 billion to -$14.5 billion over the reporting week. The bearish bias remains intact with no signs of a reversal. The price is rapidly rising.

In the long term, nothing has changed for the yen. A pullback after an intervention cannot have a long-term impact. The pair will likely move towards the 160 level again, probably followed by another intervention. The trading strategy in the current conditions involves selling just below the 160 level in anticipation of an intervention, which is quite risky but may be successful as long as the BOJ remains constrained by the prevailing situation.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

No macroeconomic events are scheduled for Tuesday—neither in the U.S., the Eurozone, Germany, nor the U.K. Thus, even if the market were paying any attention to macroeconomic data, it simply

The GBP/USD currency pair also traded higher on Monday despite no clear reasons or fundamental grounds for this movement. However, the pound has risen even on days when the euro

The total speculative bearish position on the US dollar more than doubled over the reporting week, reaching -$10.1 billion. The Canadian dollar and the yen strengthened the most, while

While Europe and parts of Asia continue celebrating Easter and political life has temporarily paused, in the U.S., the "Make America Great Again" trend set by Donald Trump continues

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.