See also

18.10.2022 12:18 PM

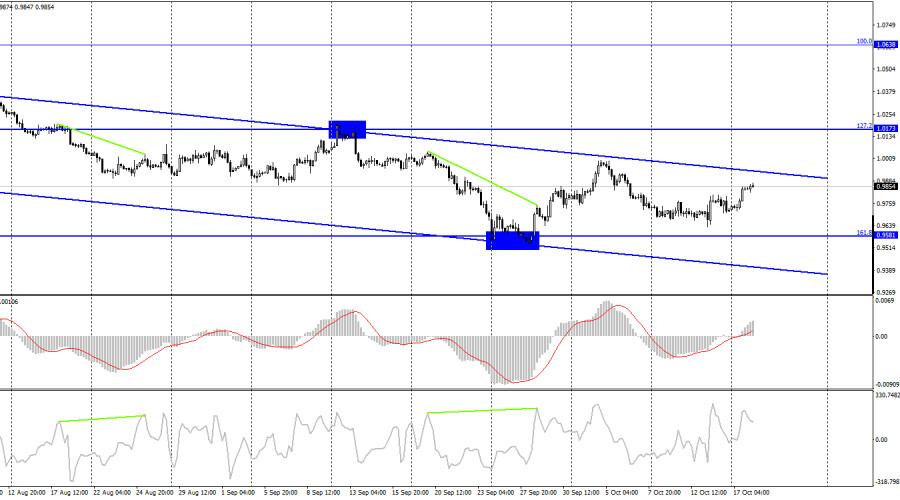

18.10.2022 12:18 PMOn Monday, EUR/USD reversed in favor of the euro and advanced to settle above the level of 0.9782. So, the pair may continue to rise towards the next Fibonacci retracement level of 323.6% at 0.9963. Last time, the upside movement stopped at his level. If the price closes below 0.9782, this will support the US dollar, and the pair may resume its fall to the Fibonacci level of 423.6% at 0.9585.

The information background is very weak at the start of this weekly session. Today, there will be only one report on industrial production in the US. The really important data on inflation in Europe will be published tomorrow. In the meantime, Goldman Sachs has revised its outlook for the European economy and the rate hike. Analysts are sure that the EU will inevitably face a recession due to soaring energy prices and energy deficit. The EU has filled its gas storage facilities in advance ahead of the heating season. Then, there was an explosion at Nord Stream pipelines. At the moment, there is only one gas supply route operating in Europe.

The European Union has long been talking about restructuring its energy system to wean itself off Russian gas supplies. So, gas supply cuts to Europe were only a matter of time. Some experts are worried that the existing gas storage volumes may not be enough to live through this winter. In this case, the EU will need to either find additional suppliers in other countries or stick to a tough energy-saving mode.

Analysts at Goldman Sachs also predict that the ECB will raise the rate by just 0.50% at its next meeting. Eventually, the rate should reach 2.75% next year. Meanwhile, interest rates in the US are set to rise higher which will serve as a strong driver for the US dollar in the coming months.

The EUR/USD pair continues to fall on the 4-hour chart towards the Fibonacci level of 161.8% at 0.9581. It is trading within the current descending channel. Therefore, the market is clearly bearish in this time frame. Only a firm hold above the descending channel will allow the euro to notably advance towards the retracement level of 127.2% at 1.0173.

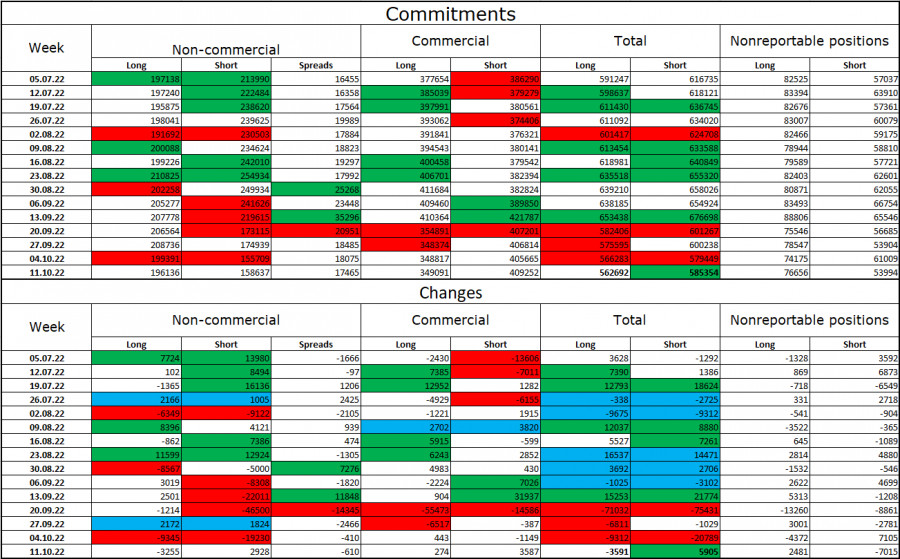

Commitments of Traders (COT) report:

Last week, traders closed 3,255 long contracts and opened 2,928 short contracts. This means that large market players became less bullish on the pair. The total number of long contracts opened by traders is 196,000 while the number of short contracts stands at 158,000. Yet, the euro is still struggling to develop a proper uptrend. In recent weeks, there were some chances for the euro to recover. However, traders are hesitant to buy it and prefer the US dollar instead. Therefore, I would advise you to focus on the main descending channel on the H4 chart although the price failed to close above it. It is also recommended to monitor geopolitical news as it tends to greatly affect the market sentiment. Eleven the bullish sentiment of larger market players does not allow the euro to develop growth.

Economic calendar for US and EU:

US - Industrial Production (13-15 UTC).

On October 18, there are almost no important events in the US and EU. There is only one report in the US that is of minor importance. So, the impact of the information background on the market sentiment will be very weak or even zero today.

EUR/USD forecast and trading tips:

I would recommend selling the pair if the price bounces off the upper line of the channel on the 4-hour chart. The target in this case should be the level of 0.9581. Buying the pair will be possible when the price holds firmly above the upper line of the channel on the H4 chart with the target at 1.0638.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

From what is seen on the 4-hour chart, the EUR/GBP cross currency pair appears to be moving above the EMA (100), which indicates that Buyers dominate the currency pair

With the appearance of Convergence between the price movement of the main currency pair USD/JPY with the Stochastic Oscillator indicator and the position of the EMA (100) which is above

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

From what we see on the 4-hour chart of the Nasdaq 100 index, there are several interesting things, namely, first, the price movement is moving below the MA (100), second

Early in the American session, gold is trading around 3,312 with a bullish bias after breaking out of the symmetrical triangle. Gold is now likely to continue rising

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.