18.10.2023 04:03 AM

18.10.2023 04:03 AMU.S. retail sales rose 0.7% in September, more than double the consensus estimate of 0.3%. Retail sales were inflated after gasoline prices spiked. However, several indicators of the state of the service sector and preliminary data on credit card transactions indicate that consumer spending has slowed compared to August.

Overall industrial production rose 0.3% in September, slightly lower than August's growth of 0.4% but higher than the forecast. Overall, these reports seem favorable for the Federal Reserve, as inflation is slowing down without signs of an economic downturn, which is typically the case. Consequently, the Fed has more room to justify either the end of the rate-hike cycle or a more extended period of high rates as a means to combat inflation, as there is no immediate need to lower rates due to an impending recession.

The threat of an escalation in the Middle East has somewhat dwindled, leading to an increase in risk appetite and is exerting slight pressure on the US dollar. In October, most of the key economic indicators in the US surpassed expectations, highlighting the strength of the US economy, which supports demand for the dollar. For the euro, the most significant risk at the moment is the energy prices, as natural gas on the TTF exchange, after a correction from October 13th to 16th, is trading higher again, mounting pressure on the single currency.

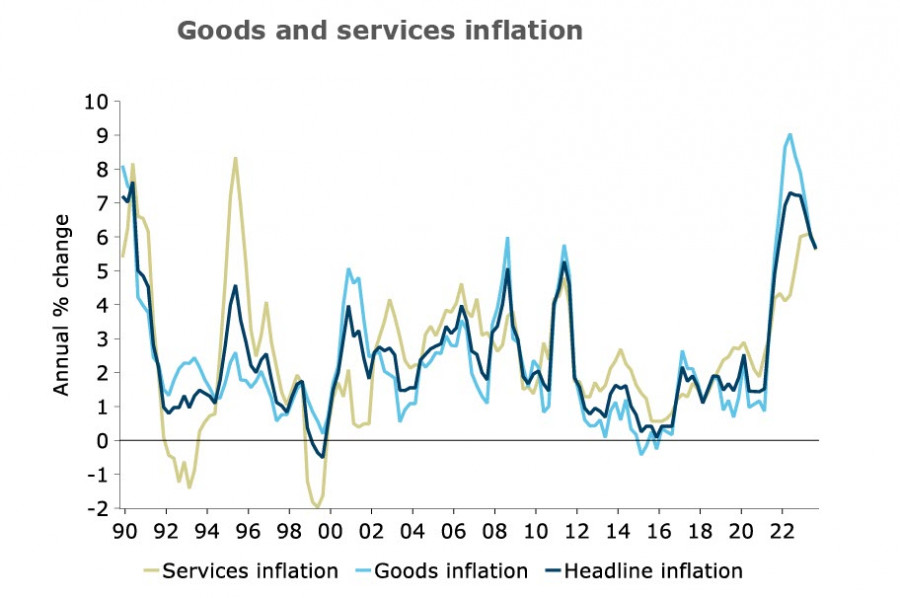

Consumer prices in New Zealand rose 5.6% year-on-year in the third quarter, slower than the 6.0% increase in the second quarter, which is below our forecast of 6.1% and lower than the Reserve Bank of New Zealand's August Monetary Policy Statement (MPS) projection of 6.0%. A surprise came from the tradable goods sector. Despite the elevated core inflation, the figures improved, which will likely please the RBNZ. The CPI without food, fuel, and energy dropped to 5.2% year-on-year (previously 6.1%). Inflation in the services sector also decreased from 6.1% to 5.6%.

The progress is evident, reducing the chances of the RBNZ raising interest rates in the near term.

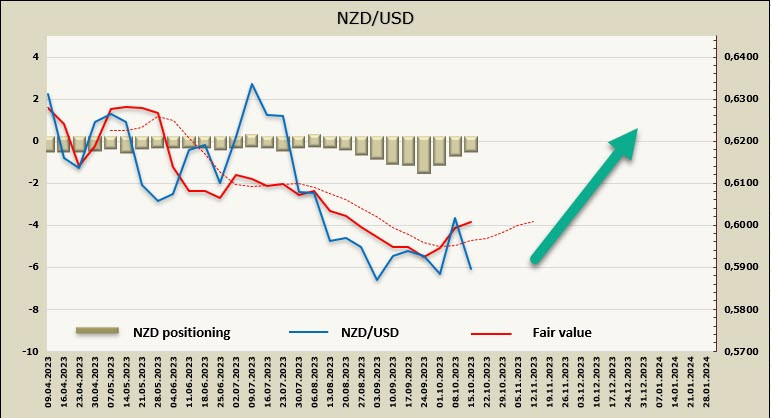

The latest data gives the RBNZ the opportunity to pause, which is clearly a bearish signal for the kiwi. Now, traders will focus on the quarterly labor market report on November 1st, and in the coming two weeks, the kiwi will likely be under slight pressure.

Net short NZD positions fell by 205 million to -247 million during the reporting week, and speculative positioning is now neutral. The price is above the long-term average and has a bullish bias.

The New Zealand dollar stands out from most commodity currencies as it tries to rise against the USD. This is largely due to the RBNZ interest rate forecast, which implies an increase in the yield spread in favor of NZD in 2024, as well as an improvement in the trade position due to the reduced threat of a Chinese slowdown. This has led to rising government bond yields. However, since the CFTC report was released before the inflation report, we can expect a correction in NZD expectations in the near future.

A week ago, we expected NZD/USD to surpass the resistance at 0.6030/50, but the inflation report disrupted these plans, so the likelihood of further gains has decreased. Trading within a range with support at 0.5850 as the lower band and the mid-channel level at 0.6000/10 as the upper band is more likely.

The inflation index for the third quarter will be published next week. Forecasts fluctuate around 1.1% quarter-on-quarter, and although this is slightly higher than the previous quarter, there is no doubt about the trend of declining inflation. For monetary policy, the continued deceleration of inflation rates remains decisive.

The slowdown in year-end price growth will be partially due to base effects, as the high figures in the third and fourth quarters of 2022 will start to weaken. Internal factors will continue to grow in importance, as global factors, primarily US inflation and China's growth slowdown, will become less significant.

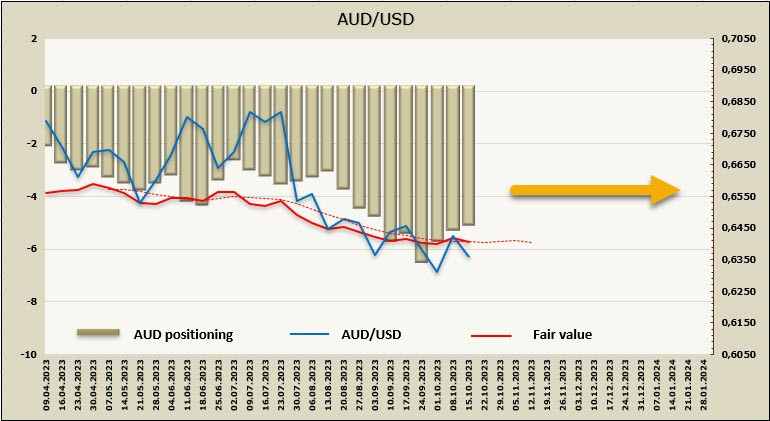

The net short AUD position has corrected by 241 million to -4.925 billion, indicating bearish bias. The price shows no distinct direction.

AUD/USD has stayed above the support level at 0.6288, but the pair failed to start a firm corrective phase. The direction is unclear, and the pair will likely trade within the range of 0.6288-0.6440/50.

市場對任何利好消息的敏感度正在增加,但其最佳時期已經過去。以美國股票占MSCI所有國家世界指數的百分比來看,其價值在十二月份達到峰值。

美國總統唐納·川普表示,在任何貿易談判中,他計劃對中國保持非常「禮貌」的態度,並且如果兩國能達成協議,關稅將會降低。此言論後,美國美元兌多數主要貨幣驟然上漲。

週四預計只有少數宏觀經濟事件發布,但昨天的發展已經顯示出市場開始忽視大部分的數據發布。只有少數報告能夠被幸運地納入市場定價。

週三,英鎊/美元貨幣對成功避免了大幅下跌,儘管在此之前,看起來似乎已經開始下跌趨勢。但市場迅速反彈,認識到基本背景並沒有發生改變。

电子邮件/短信

通知

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.