09.05.2023 11:10 AM

09.05.2023 11:10 AMSometimes the answer to the question of why the price has risen is extremely simple: it was low. The three-day Brent rally following a three-week decline in North Sea oil prices is an example of this principle being realized. The oil market looked oversold. Neither macroeconomics nor fundamental indicators confirmed its serious collapse. Moreover, Vortexa data shows that the amount of oil stored on stationary tankers has fallen to its lowest levels since mid-February.

The main drivers for Brent's peak in recent weeks were investors' belief in a recession in the U.S. economy and distrust in Russia. The latter announced a 5% reduction in oil production. However, export data suggests that this could be false. In the end, misleading information could drive a wedge between Moscow and Riyadh, affecting OPEC+ efforts to stabilize the market.

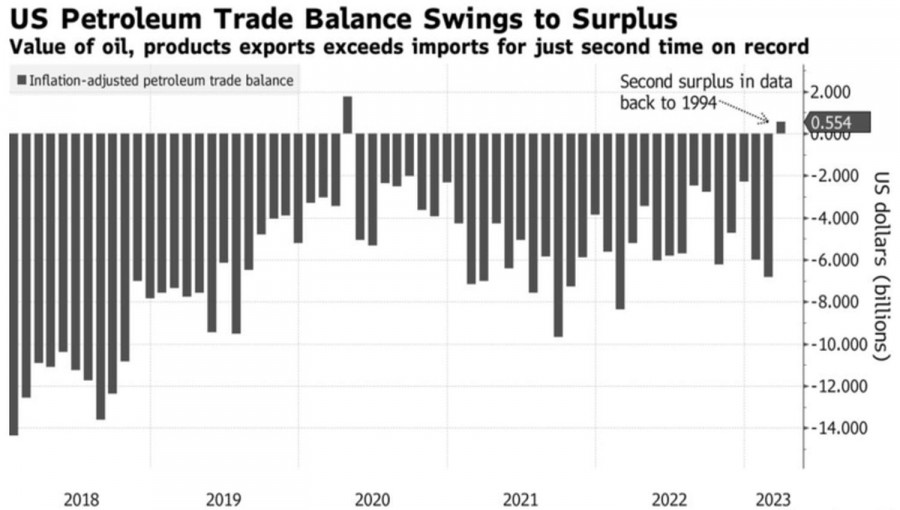

Expectations of a downturn provoked by the most aggressive tightening of monetary policy by the Federal Reserve in decades have pulled Brent quotes into the abyss. Since 1974, the Federal Reserve,on average, began lowering rates five months after they peaked. Under current conditions, monetary expansion would be tantamount to a downturn and reduced demand for oil. Especially considering that in March, the U.S. became a net oil exporter for the second time in history since 1994.

Dynamics of the U.S. oil trade balance

Oil shipments abroad increased by 24% to a record $27.6 billion, the fastest growth rate since 2017. At the same time, imports rose to $27.1 billion, the worst figure since November.

The demand for gasoline in the U.S., which usually grows in anticipation of summer, did not inspire optimism for oil fans either. Unfortunately, its dynamics lag behind the indicators of previous years. This fact is also considered negative for oil.

However, strong employment statistics in the U.S. have relieved the burden of responsibility on Brent bulls' shoulders. If the U.S. labor market is strong as a bull, what recession could we be talking about? Most likely, investors are confusing the desired reduction in the federal funds rate by the end of the year with reality. If there is no recession, China continues to recover from COVID-19, and the eurozone economy remains resilient, rumors of a slowdown in global demand for oil will be greatly exaggerated.

As for supply, forest fires in Canada have displaced about 300,000 people and forced companies to shut down oil production by 200,000 bpd. Moreover, voluntary production cuts by some OPEC+ countries will begin in May, affecting the oil market balance.

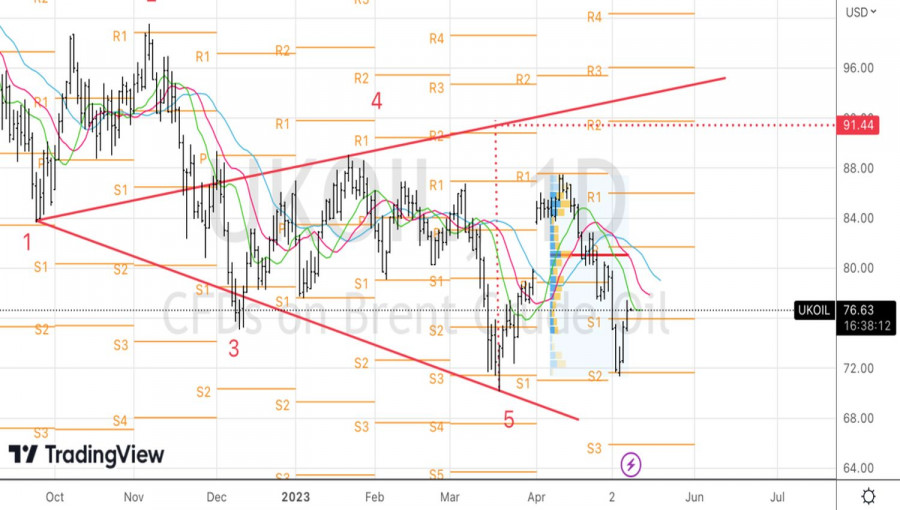

Technically, on the daily chart, Brent's formation of reversal patterns such as Wolfe Wave and Double Bottom indicates that the worst for the North Sea grade is already behind. The successful test of resistances at $77.6 and $79.1 per barrel will be a reason for its purchases.

市場對任何利好消息的敏感度正在增加,但其最佳時期已經過去。以美國股票占MSCI所有國家世界指數的百分比來看,其價值在十二月份達到峰值。

美國總統唐納·川普表示,在任何貿易談判中,他計劃對中國保持非常「禮貌」的態度,並且如果兩國能達成協議,關稅將會降低。此言論後,美國美元兌多數主要貨幣驟然上漲。

週四預計只有少數宏觀經濟事件發布,但昨天的發展已經顯示出市場開始忽視大部分的數據發布。只有少數報告能夠被幸運地納入市場定價。

週三,英鎊/美元貨幣對成功避免了大幅下跌,儘管在此之前,看起來似乎已經開始下跌趨勢。但市場迅速反彈,認識到基本背景並沒有發生改變。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.