আরও দেখুন

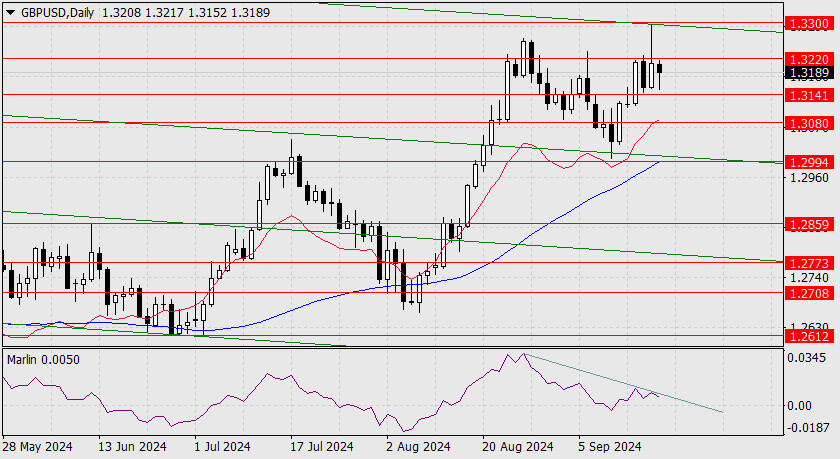

Yesterday, the British pound, in sync with other currencies, leaped upward, reaching a technical level — for the pound, this was the resistance level of 1.3300 (with a small margin of error). The upper boundary of the price channel was breached, and the channel took on a new shape. This morning, the pound is actively declining, with the target being the nearest embedded price channel line around the support level of 1.2994 or slightly higher (1.3000) at the March 2022 low.

The Marlin oscillator is close to crossing into bearish territory. Yesterday's price surge allowed the formation of a powerful classic divergence. The key support at 1.3080 is the nearest target on the way to 1.2994-1.3000.

The Bank of England's meeting will take place today. After yesterday's decision on the Federal Reserve rate, any decision from the BoE will not help strengthen the pound. The consensus forecast suggests maintaining the current rate. In this case, investors expect dovish statements, or there could be a moderate rate cut of 0.25%.

A divergence has also formed on the four-hour chart. Marlin is already in negative territory. If the price tests the intermediate level of 1.3080, it will automatically lead to a break below the support of the MACD line.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।