আরও দেখুন

02.11.2023 09:11 AM

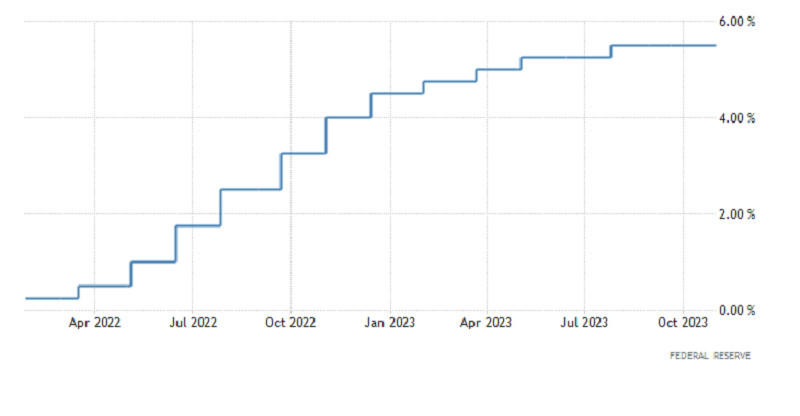

02.11.2023 09:11 AMThe Federal Open Market Committee decided to keep the refinancing rate unchanged but still left the door open for further interest-rate hikes in the future. In theory, this should have prompted the US dollar to rise further. However, that didn't happen. In fact, the pound even returned to the levels it was at the day before, prior to the release of the eurozone inflation data. This might be due to Federal Reserve Chair Jerome Powell. He explicitly mentioned that further rate hikes could have a negative impact on the economy, whereas the central bank aims for the opposite. This is the first such statement made in such plain sight. Thus, it appears that the US central bank is starting to prepare the public for the gradual easing of monetary policy. It's this abrupt change in stance that has led to the US dollar's weakness.

The Bank of England will hold its meeting today, and the results will likely be similar. Hints of an imminent interest rate cut are expected to be even more explicit and direct. This is likely to lead the foreign exchange market back to the levels it was at before yesterday's FOMC meeting.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.